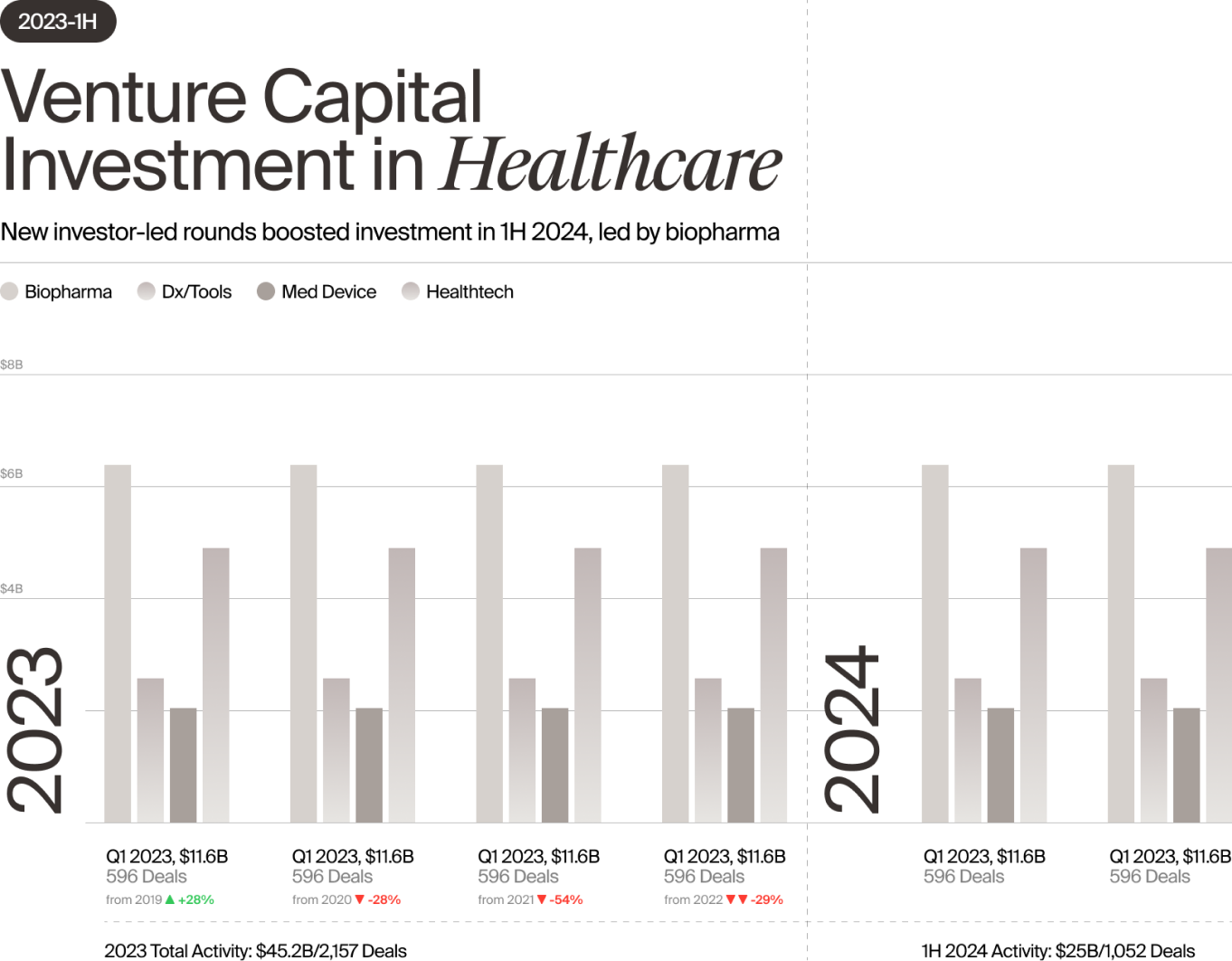

Ater a difficult couple of years, healthcare venture funding appears to be on the mend, with positive signs in the first half of 2024 quelling fears of a more extended downturn and fostering an environment of cautious optimism.

There was “increased investment across every sector” in 1H 2024, including Healthtech, Med Device, Biopharma, and Diagnostics, and “numerous” new investor-led rounds, according to Jonathan Norris, managing director of HSBC Innovation Banking, writing in the latest HSBC US and Europe Venture Healthcare Report, released in July.

That optimism was echoed by Silicon Valley Bank (SVB) in its Mid-Year 2024 Report on Healthcare Investments and Exits, released in August, which also found “signs of recovery” across all sectors. Median Series A valuations in the device sector were at an “all time high” in 1H 2024, the report noted, and VC fundraising was “impressive” despite the highest federal funds rate in decades. Although fundraising cycles have lengthened since 2021, healthcare VCs in the US and Europe closed on more than $9 billion in capital in the first half of 2024, with $6 billion more in process, according to SVB.

Cautious Optimism

Despite the good news, there are some lingering challenges that could weigh on performance going forward, including a weak exit environment, the continuing impact of insider rounds (a common tool used to bridge the funding gap in 2023), and overaggressive valuations leftover from 2021’s frothy, pandemic-driven investment frenzy.

Although the industry appears to have “largely shaken off 2023’s malaise,” writes Norris, those companies still relying on “dwindling” insider cash “will need to find a new lead investor or else face consolidation or shutdown.” Moreover, since only about half of the unicorns formed during the pandemic investment bubble in 2020 and 2021 have come back to raise another round, valuations are still in the crosshairs and “the markdown hammer has yet to fully drop,” cautions SVB.

Although funding was up, investments in the first half split the start-up field clearly into two baskets: “the haves and the have nots,” according to SVB, with VCs “increasingly focused on quality over quantity.” Moreover, deals may take longer to put together, with many investors waiting to form solid syndicates before pulling the trigger, and checks may be smaller than anticipated. Although down rounds are not as common as in 2023, down or flat rounds are still sitting at “the highest level in recent decades,” the SVB report states.

Turning the Corner?

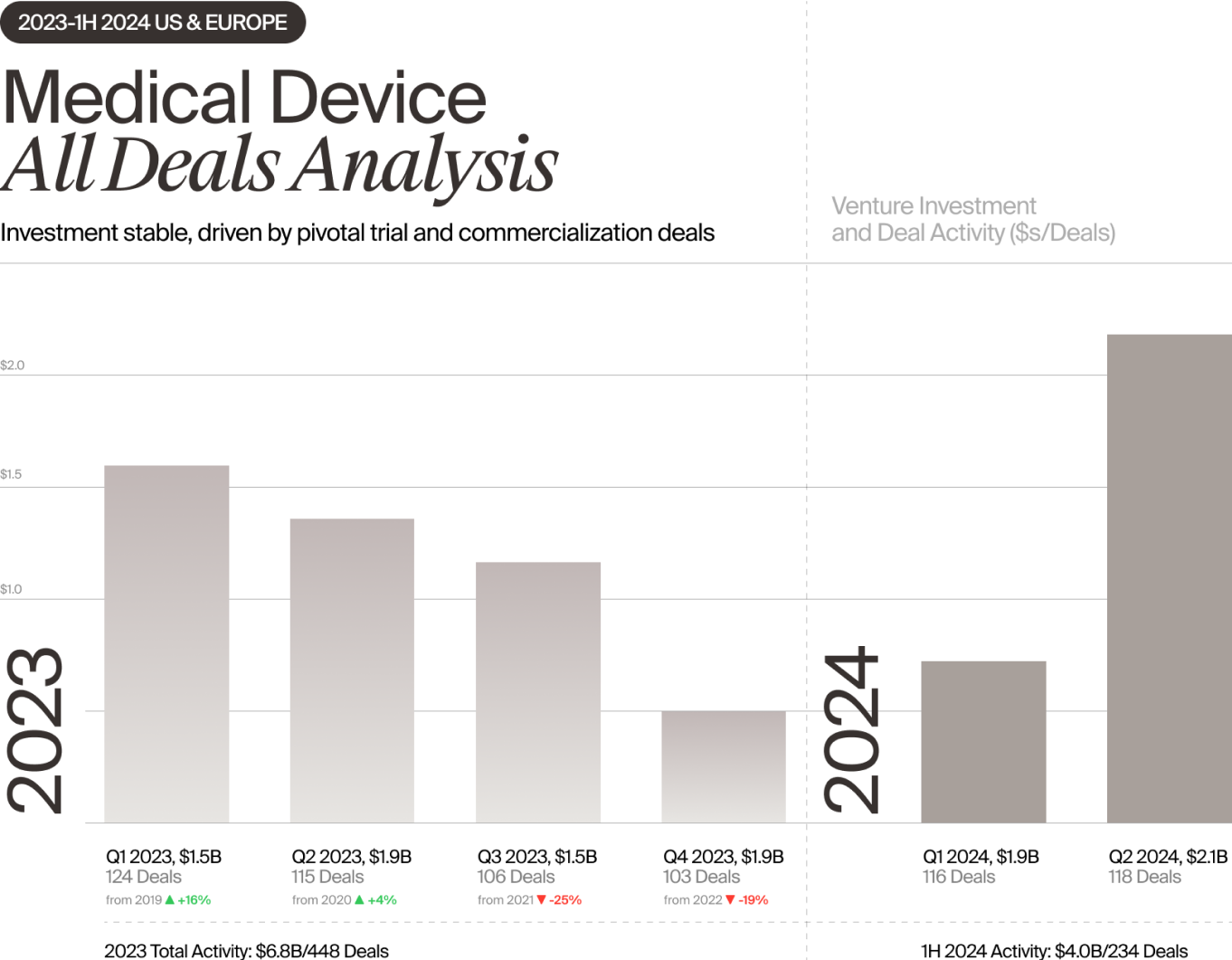

Still, the data thus far are encouraging. Healthcare investment in the first half totaled $25 billion, $4 billion of which went to the medical device sector, according to Norris. That puts Med Device on track to surpass 2023 investment levels and come close to 2022’s funding total. And that is very welcome news for an industry that has endured two years of tumult and uncertainty.

Ironically, the difficulties began in 2021, at the height of the pandemic, when an unprecedented amount of investor money flowed into healthcare. Much of that money was aimed at technologies that could enable remote care, and a good deal came from investors who were new to medtech and unfamiliar with its typical valuations and returns. The influx drove up company valuations to unrealistic levels, particularly in the digital health sector, and in the second half of 2022, when pandemic concerns waned and economic conditions worsened, the industry faced a reckoning.

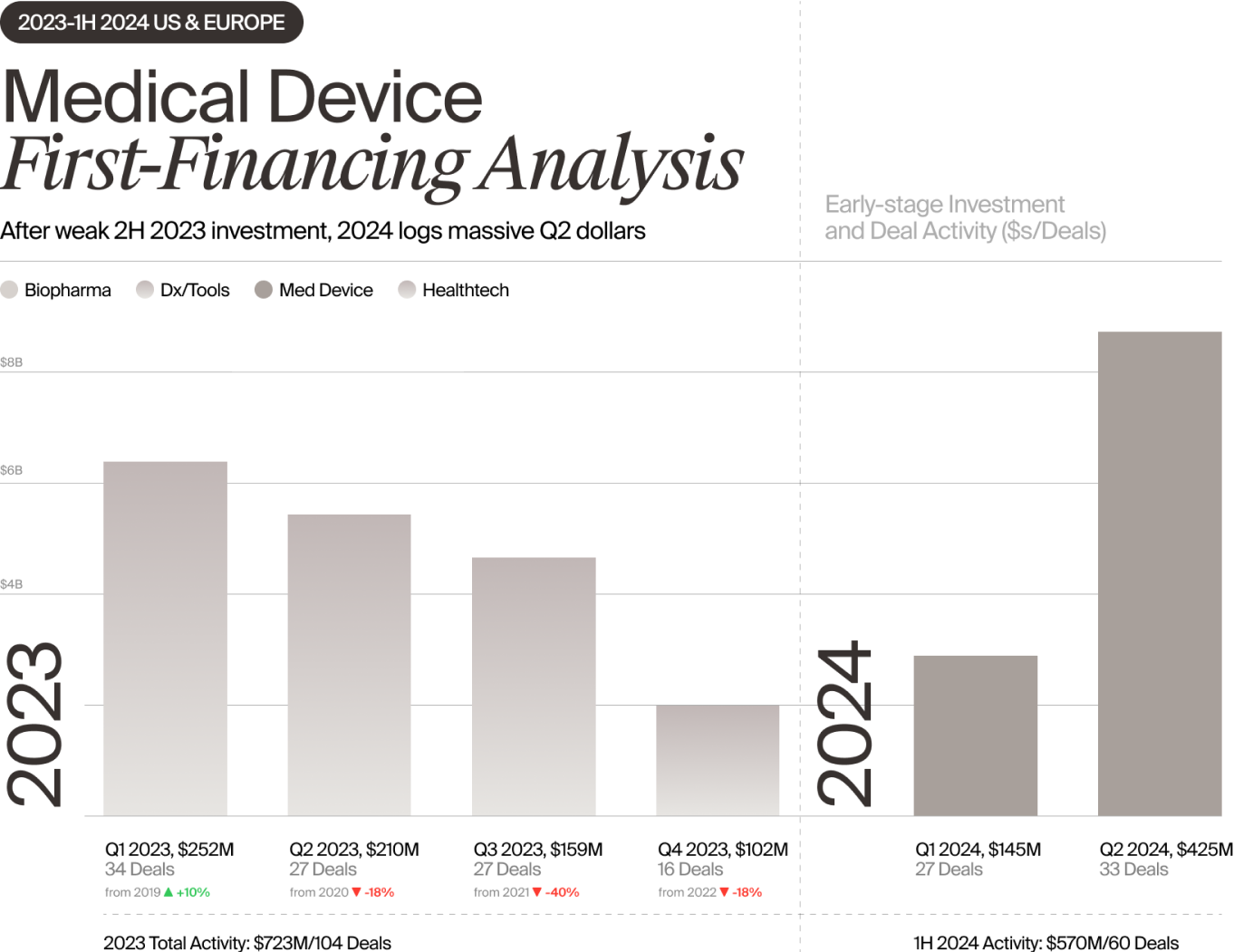

Early-stage medtech financing was hit particularly hard as investors stepped back and focused on supporting their existing portfolios. In 2023, first-financing investment in medical devices (defined as initial seed or Series A funding of $2M+) declined by 18% compared with the previous year, according to Norris, driving down the number of overall deals in the medical device sector by 20%. Total dollars invested remained steady due to the strength of later-stage deals, but many companies relied on insider rounds and nearly one in three Series B and later deals led by a new investor were down rounds.

Encouraging 1H Trends

With medtech clearly in a period of transition in 2023 and investment dollars harder to come by, many observers predicted more pain to come in 2024. However, the investment picture this year thus far is much rosier than anticipated, an indication of the healthcare sector’s resilience and of continued confidence among seasoned investors. Even Healthtech, which experienced a particularly acute investment decline in 2023, was able to reverse course in 1H 2024, with fewer later-stage companies reliant on insider rounds and a surge in early-stage financing (led by AI-based technologies).

The Med Device sector also saw a substantial increase in first-financing deals in 1H 2024, with $570 million invested in 60 deals, according to Norris. The bulk of that dealmaking occurred in the second quarter, with $425 million invested in 33 deals, a rapid upswing that set a four-year quarterly investment record. Many of those deals involved syndicates that included both VCs and corporate investors.

New investors also led a substantial number of Med Device Series B rounds, and there were fewer down rounds overall. The percentage of down rounds led by new investors in Series B and later deals fell from 33% in 2023 to 20% in 1H 2024, with an increase in median pre-money valuations.

Some clinical areas benefited more than others. Investors seeking new opportunities were drawn to high-growth areas such as neuro, which garnered the largest share of Med Device first-financing money in 1H 2024. And they were much more willing than they were a year ago to fund device startups requiring extensive clinical trials, such as those pursuing the cash-intensive PMA regulatory pathway. In fact, larger pivotal trial fundings and 510(k)-cleared commercialization rounds accounted for much of the early-stage funding growth that occurred during the first half, according to Norris.

Investors Confident, but Careful

All of this suggests that investor confidence is on the rise. As SVP notes in its recent report, “the combination of improving numbers and investor sentiment in the [device] space makes us cautiously optimistic that investment in devices is turning the corner.”

But while the picture is brighter than it was a year ago, the industry hasn’t completely shaken off the angst of the past couple of years. Traditional medtech investors have been very successful at raising cash, so there is money to be spent. But as they pick up the pieces left after the pandemic rush, and with exits currently constrained, they are pickier than they were in the past and somewhat more risk averse.

investors are looking for start-ups that check all the boxes. That includes companies targeting significant unmet needs with solutions that fit well into existing workflows, a clear path to reimbursement/profitability, preferably with some clinical data to back up their claims, a seasoned management team, and low cash burn. In addition, they are more inclined to share the risk by pulling together multifaceted syndicates that include VCs along with other stakeholders such as corporate investors and large provider systems.

Finding an Exit

The wild card for investors is the exit environment, which was disappointing in the first half of 2024, with fewer M&A deals than anticipated and a dearth of IPOs. Some potential buyers may still be waiting for further valuation adjustments, and with the IPO window essentially closed at the moment, corporate acquirers can afford to wait and shop around for the best deal.

Although some analysts are predicting an uptick in exits by the end of this year or early next, a scenario that SVB notes could “spark a wave of new private investments,” there are still unpredictable economic and geopolitical factors at play that could slow the exit recovery.

IPOs have been particularly sparse so far this year. The one medtech company that did go public during 1H 2024—Fractyl Health—has not performed well in the aftermarket (Fractyl, which went public in February, is developing endoscopic hydrothermal ablation devices designed to treat metabolic diseases, including diabetes and obesity. The company’s stock was initially priced at $15 per share but is now hovering around $2 per share).

However, there have been several successful M&A deals completed or announced during the first half, which adds to the positive momentum. Perhaps most notable is Boston Scientific’s planned $1.26 billion acquisition of carotid intervention company Silk Road Medical, announced in June. Silk Road nicely complements Boston Scientific’s peripheral interventions unit and bolsters the company’s presence in the potentially multi-billion-dollar global carotid disease market.

Silk Road is the second large M&A deal announced by Boston Scientific this year. In January, the company inked a $3.7 billion agreement to acquire Axonics, a company with neuromodulation devices for incontinence. Both the Axonics and the Silk Road deals are currently under FTC review, which will delay the anticipated closing dates.

Despite the current challenging environment, Boston Scientific remains one of the most active medtech strategic acquirers, typically completing a “good handful” of acquisitions every year, according to Michael Ryan, Boston Scientific’s VP Venture Capital & Business Development, speaking at LSI’s 2024 USA conference during a panel entitled “Corporate VCs: What They Want and How They Align with M&A and Business Development.”

But even Boston Scientific has been looking to de-risk its investments. Although Ryan noted that the company does occasionally acquire pre-commercial entities, its most recent deals have focused on companies that are already generating significant revenue. “Most of our acquisition dollars and activity goes towards companies that have been further de-risked, have demonstrated that there’s market demand and reimbursement, and already have a revenue trajectory,” he said.

That desire to de-risk is much more prevalent than it was a few years ago, according to Bennet Blau, a managing director with Goldman Sachs, who spoke at the same meeting during a panel session entitled “Medtech M&A 2024: Looking Onward and Upward.” The amount of capital available for M&A remains “exceptionally high,” Blau noted, but the bar is now much higher. “The criteria have increased substantially in terms of de-risking, of checking the box not only on growth, but quality growth, recurring revenue, and good business models.”

Chris Eso, Medtronic’s VP, Global Head of Corporate and Business Development M&A and Ventures, agreed, noting during the same panel session that right now, the overall aim of M&A for Medtronic is to “improve our earnings power” and “get our ma-rgins back to where they were pre-pandemic.” That said, he pointed to some macro headwinds that are impacting M&A activity in 2024, including inflation, high interest rates, and low stock prices. In that environment, it’s difficult to find M&A offering a near-term growth opportunity at a reasonable valuation, he said. That could improve over the next several months, but in the meantime, Medtronic is “still looking and active, we just haven’t pulled the trigger on a lot of things.”

Chris Eso, Medtronic’s VP, Global Head of Corporate and Business Development M&A and Ventures, agreed, noting during the same panel session that right now, the overall aim of M&A for Medtronic is to “improve our earnings power” and “get our ma-rgins back to where they were pre-pandemic.” That said, he pointed to some macro headwinds that are impacting M&A activity in 2024, including inflation, high interest rates, and low stock prices. In that environment, it’s difficult to find M&A offering a near-term growth opportunity at a reasonable valuation, he said. That could improve over the next several months, but in the meantime, Medtronic is “still looking and active, we just haven’t pulled the trigger on a lot of things.”

Medtronic is unique because it was one of the first large strategics to align itself with a private equity firm—Blackstone—which has invested “well over a billion dollars” to help fund some of Medtronic’s growth objectives, according to Eso.

And, Eso noted that de-risking those investments is a big part of the appeal of working with partners such as private equity firms. “We need some more later-stage dollars like Blackstone to take the clinical and reimbursement risk so that we’re taking the commercial risk,” stated Eso. “That’s what we’re good at—taking a technology and driving it to standard of care. But everybody has their piece that they do really well, and we as an ecosystem have to work together across the board.”

Even though strategics are being more cautious, they are doing deals. In addition to the large acquisitions announced by Boston Scientific, Stryker closed on several tuck-in acquisitions this year, and plans to add more as the year progresses. And Edwards Lifesciences has also been on something of a buying spree lately.

In March, Stryker acquired French ortho implant company Serf, followed in July by two more tuck-ins: soft tissue fixation company Artelon and Molli Surgical, which has a breast cancer surgical marker.

Stryker’s latest deal, announced in August, is a definitive agreement to acquire care.ai, which provides AI-assisted virtual care solutions, including smart sensors and other smart room monitoring systems, to hospitals and other care providers. According to care.ai, the technology will assist Stryker’s customers, who continue to face nursing shortages, employee retention challenges, overworked staff, and workplace safety concerns, and will fit “seamlessly” into Stryker’s Vocera communication platform.

Edwards Lifesciences announced three acquisitions this summer involving both early- and late-stage companies, all of which fit well into Edwards’ existing structural heart business. In mid-July, Edwards announced that it had exercised its right to acquire early-stage transcatheter mitral valve replacement company Innovalve for an undisclosed amount. Edwards has been an investor in the company since 2017 and noted in the announcement that Innovalve had demonstrated “promising early clinical experience.”

This was followed about a week later by agreements to acquire JenaValve Technology and Endotronix. JenaValve brings the Trilogy Heart Valve System for aortic regurgitation, which is expected to be FDA approved in late 2025, and Endotronix recently received FDA approval for Cordella, an implantable pulmonary artery pressure sensor for people with heart failure. Edwards had been an investor in Endotronix since 2016 and held an option to acquire the company.

Individual purchase prices were not disclosed, but Edwards said the aggregate upfront purchase price for JenaValve and Endotronix was about $1.2 billion. The company expects all three acquisitions to strengthen its leadership position in structural heart and offer long-term growth opportunities.

Will the Momentum Continue?

With healthcare investment showing positive momentum in the first half of the year, the question now is whether that momentum will continue through the end of 2024 and beyond. Although the early signs are hopeful, with US election uncertainty and continuing economic concerns potentially casting a shadow well into the fall, it could be early 2025 before things are truly back on a more normal course.

And for some companies, this uncertainty is creating an existential moment. Surgical robotics company Asensus Surgical, for example, recently told its shareholders that if they did not approve a pending 35-cents per share merger with Karl Storz, Asensus would be forced to file for bankruptcy.

Although analysts such as Norris do anticipate more industry consolidation and company shutdowns in the second half of the year, particularly as insider cash runs out, the outlook for the most part is optimistic. As HSBC notes in its 1H 2024 report, 2024 activity has demonstrated the healthcare investment community’s ability to find a path forward despite headwinds. “We are now seeing healthy and sustainable investment revitalize optimism for a solid, albeit bumpy, second half of the year.”