Medical Devices & Diagnostics (MD&D) companies know they are being impacted by the current pandemic and are seeking independent research to quantify how much their markets will decline or increase, how long the recovery will take, and what factors will determine that recovery.

A new surveillance tool to track the Impact of COVID-19 on medical devices & diagnostics markets is now available through research firm Life Science Intelligence (LSI). This new tool includes content from a recently published report written in collaboration with LSI's longtime strategic partner, Health Research International (HRI).

According to LSI CEO Scott Pantel, “We’ve had an overwhelming number of clients -- from both the medtech and financial services communities -- come to us asking for guidance on how their markets are going to be impacted. Everyone is generally asking the same questions: How will medtech markets be impacted in the short-term and when will they rebound? How can we protect vulnerable business units and leverage opportunities in others? Which surgical procedures are being postponed, when will they bounce back, and how fast, so we can be ready?” Pantel adds that “LSI has been covering medtech markets for over 2 decades and we’ve been through crises like these before, 2018 as an example, but this situation is much more complicated with so many moving parts. Because of this, we’ve rolled out a new tracking tool to support our customers and their strategic decisions as best we can during these uncertain times.”

The new tool provides logical and thoroughly-researched forecasts.

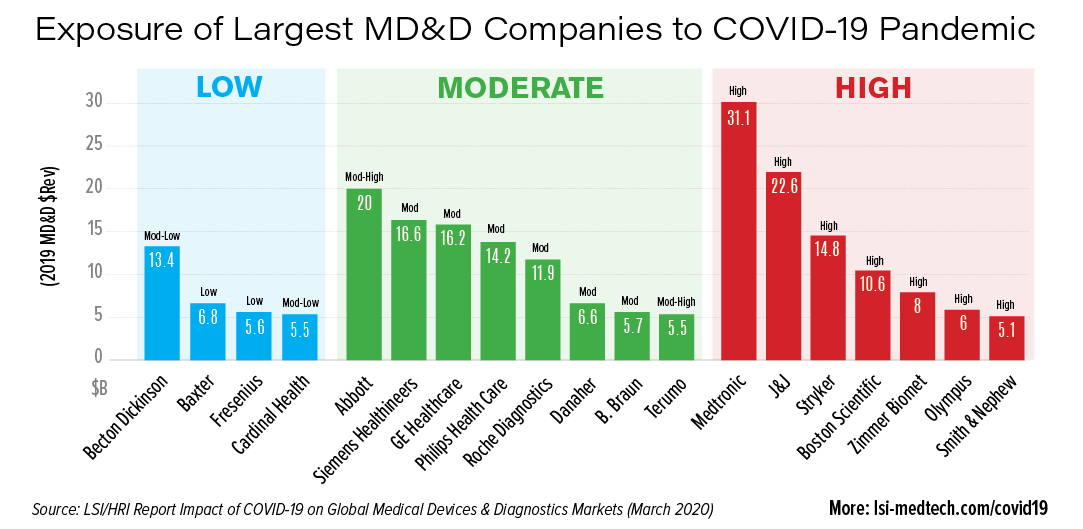

Early research indicates that the largest medical device & diagnostic companies in the world will see varying levels of exposure.

High Exposure

- Medtronic

- J&J

- Stryker

- Boston Scientific

- Zimmer Biomet

- Olympus

- Smith & Nephew

Moderate Exposure

- Abbott

- Siemens Healthineers

- GE Healthcare

- Philips Health Care

- Roche Diagnostics

- Danaher

- B. Braun

- Terumo

Low Exposure

- Becton Dickinson

- Baxter

- Fresenius

- Cardinal Health

The full report examines:

- Surgical caseloads by major type (emergent, non-emergent, elective)

- 30+ technology markets by major type

- Markets by major geography

- Clinical markets by major type

For more information check out COVID-19 Impact Tracker.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy

Subscription Includes

Global Medtech Market Analysis & Projections (MAP), 2021-2031 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Surgical Procedure Volumes Dashboard, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

United States Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Aesthetics, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Cardio, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

ENT, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

General, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Neuro, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

OB/GYN, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Ophthalmology, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Orthopedic, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Peripheral Vascular, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spine, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

SRS, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Urological, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Global Markets for Hip Replacement Implants, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Guidewires, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Atherectomy Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Electrosurgery, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Balloons & Vena Cava Filter, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Mechanical Heart Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tissue Heart Valve Replacement, 2023-2028 Published:

2023 Next Update:

Q2 2030 Deliverables:

2023

Q2 2030

Global Markets for Transcatheter Mitral Valve Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Femoral Closure, 2023-2029 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tricuspid Valve Repair, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Percutaneous Pulmonary Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Coronary Angio Guidewires & Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Oncology Ablation Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for ENT Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Cell Delivery Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Urology Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for External Pain Pumps, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Ureteral Access Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Pelvic Floor Repair, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Atrial Fibrillation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neurovascular Devices Ischemic, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neuromodulation Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Vertebroplasty Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Benign Prostation Hyperplasia Implants, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Cryoablation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Diagnostic Electrophysiology Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Hernia Repair, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for CRM Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Neurovascular Devices Hemorrhagic, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Renal Denervation, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Upper+Lower Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Peripheral Stents, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electromagnetic Navigation Systems, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for GI Endoscopy, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Hemodialysis, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Globals Markets for Cardiac Ablation, 2023-2028 Published:

Next Update:

Deliverables:

Global Markets for Atrial Septal Occlusion, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Aortic Grafts, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Interventional Cardiology Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Oncology Embolization, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Vascular Access Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Rotator Cuff Repair Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electrical Stimulation Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Wearable Monitoring Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Low Complexity Medical Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Canada Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Germany Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

France Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

U.K. Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Italy Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spain Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Poland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Netherlands Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Belgium Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Sweden Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Switzerland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Denmark Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Finland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Norway Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

China Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

India Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Japan Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Korea Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Australia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Thailand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Malaysia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Singapore Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

New Zealand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Caribbean Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Argentina Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Colombia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Chile Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Guatemala Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Dominican Republic Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Costa Rica Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Panama Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Mexico Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Brazil Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Turkey Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Russia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Africa Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024