- Q1-Q3 2024 Deals Exceed 2023

- Smaller Rounds Drive Medtech Venture

Investment and Licensing Upfronts - Medtech Giants Are Getting Bigger

- Other key report findings

- Billion-Dollar-Plus Medtech Deals

Announced in 2024 - Large Players Divesting and Recalibrating

- Fuel for Growth: Medtech Continues to Innovate

- 2025: Into the Great Wide Open

The medtech M&A landscape in 2024 has soared past the benchmarks of 2023, with innovation, VC and FDA support acting as the engines driving its ascent. As the industry gains altitude, the flight path indicates a bustling and strategically pivotal 2025.

Medtech ecosystem stakeholders, please fasten your seatbelts. Mergers and acquisitions (M&A) as we approach the runway to 2025 are expected to be turbulent, with tailwinds provided by accelerated innovation in compelling frontiers such as AI, that promises to revolutionize healthcare, VC investment, and continued regulatory support of novel device technology. The industry will be navigating through pockets of high-stakes negotiations, where every acquisition feels like a daring ascent, and every partnership, a critical adjustment to stay on course. Buckle up—standing still isn’t an option at this altitude.

Just like the friendly skies, the medtech space is filled with companies determined to reach their destination: market leadership, propelled by innovation, strategic and synergistic alignments, and the pursuit of transformative patient outcomes. But in this race, only those who navigate the turbulence with adaptability and strategic collaboration will beat the competition. This year has seen some elevation in the M&A space, with high-dollar bets along with room for improvement as we prepare to mark a quarter of the way through this century.

Q1-Q3 2024 Deals Exceed 2023

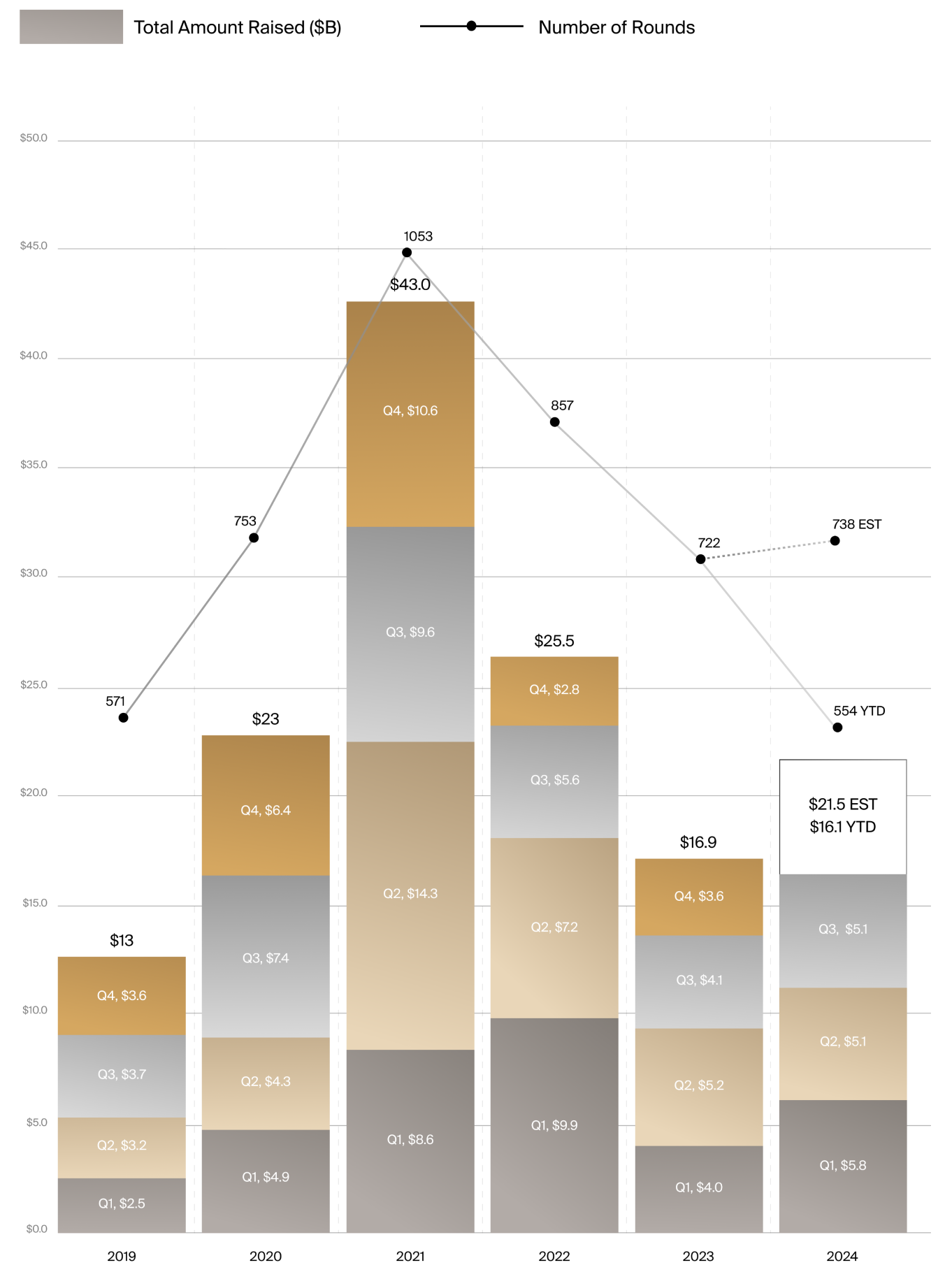

Medtech venture investments and M&A are signaling a positive year in 2024, with activity reported through the third quarter set to beat full-year 2023 numbers, according to the Q3 2024 Medtech Licensing and Venture Report from J.P.Morgan and DealForma.

From Q1 to Q3 of this year, medtech venture activity totaled $16.1 billion across 554 funding rounds, according to the J.P.Morgan and DealForma report (see chart).

In Q3 2024 alone, venture investments totaled $5.1 billion across 154 rounds, up approximately $1 billion compared to the same period in 2023. Robust venture activity is helping 2024 to post over 27% annual growth.

Through Q3 2024, 195 medtech acquisitions totaled $47 billion in value. This compares to FY 2023, when 128 medtech M&A deals were announced, totaling over $50.1 billion.

In terms of medtech licensing and partnerships, the 744 medtech deals announced through Q3 2024 have disclosed $4.7 billion in total deal value, with $400 million in upfront payments, according to the J.P.Morgan and DealForma report.

Initial public offerings also showed signs of life this year, with a handful of companies raising over $700 million on NASDAQ and NYSE. This follows no U.S. medtech IPOs in 2023. The companies going public thus far in 2024 include Fractyl Health with $110 million in Q1, Tempus AI with $411 million in Q2, and CeriBell with $188 million in Q3.

Smaller Rounds Drive Medtech Venture

Investment and Licensing Upfronts

Venture investment and licensing partnership upfront check sizes in the medtech sector remained relatively modest through the first three quarters of 2024, according to the J.P.Morgan and DealForma report. Most venture funding rounds for medtech companies came in at under $50 million, and upfront payments for R&D licenses concentrated below $10 million.

Medtech Giants Are Getting Bigger

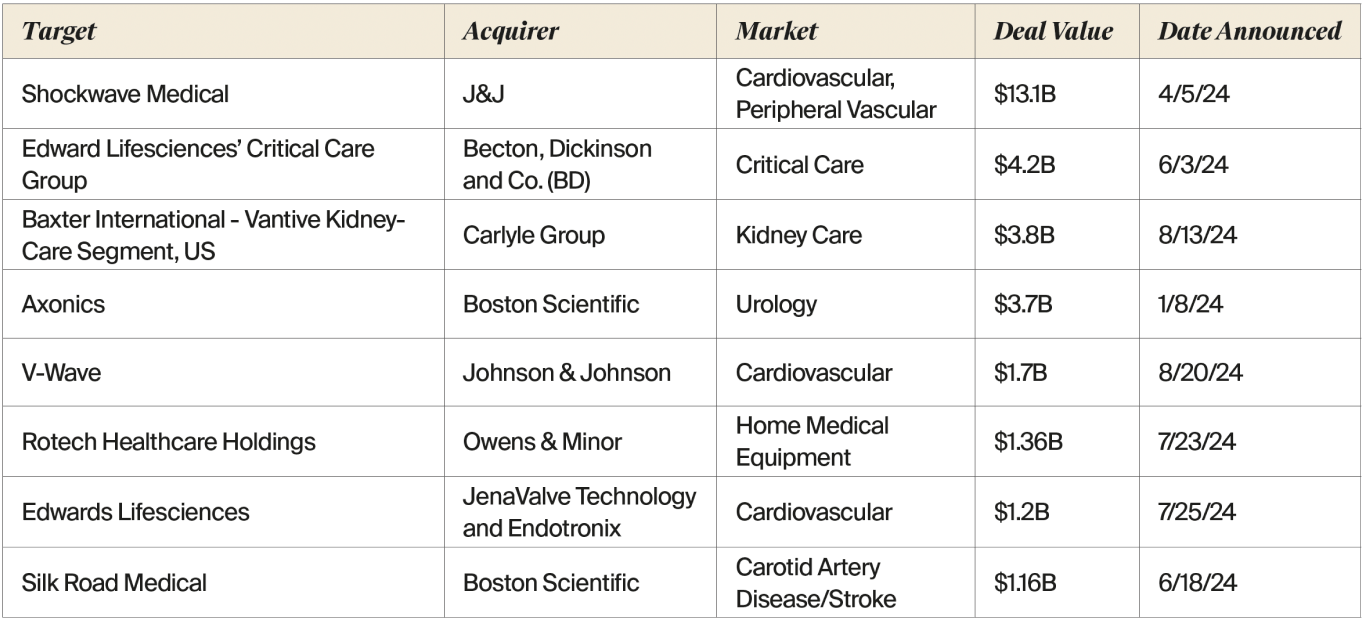

A cadre of large strategics have shelled out big bucks for highgrowth opportunities, primarily in the cardiovascular space, in 2024. Hefty deals include Johnson & Johnson’s $13.1 billion purchase of Shockwave Medical (this acquisition alone accounted for 23% of the annual total M&A investment, according to EY), the industry giant’s purchase of heart failure company V-Wave for $1.7 billion, and Edwards Lifesciences’ $1.2 billion dual purchase of JenaValve Technology, with a transcatheter valve aimed at aortic regurgitation, and implantable heart failure monitor company, Endotronix (see table below).

J&J is banking on big returns from Shockwave, with its successful intravascular lithotripsy technology used to treat atherosclerotic cardiovascular disease by applying sonic waves to disrupt plaques. Shockwave’s attractiveness lies in its value proposition: it reported $730.2 million in revenue for the full year 2023, representing an impressive 49% increase year-over-year. In July, J&J increased its operational sales guidance for the full year 2024 by $500 million to reflect the completion of the Shockwave acquisition. Company representatives also reported that Shockwave is well-positioned to become J&J’s thirteenth business with sales in excess of $1 billion annually. (For more on Shockwave’s journey to this epic exit, see the cover story in this issue, “Long Game Legends: Makower and Papiernik’s Playbook for Success.”)

Other key report findings

383 of the 486 disclosed medtech venture rounds through Q3 2024 have been under $50 million, though there have been 36 so far, valued at over $100 million.

Some of the largest medtech venture rounds in Q3 2024 include the private rounds for Element Biosciences at $277 million (Series D led by Wellington Management with participation from new and existing investors, including Samsung Electronics, Fidelity, Foresite Capital, funds and accounts advised by T. Rowe Price Associates, Inc, and Venrock, among others) and women’s health-focused digital consumer app company Flo Health, at $200 million (Series C investment from global growth investor General Atlantic).

Medtech partnership and licensing upfront payments finished the first three quarters of 2024 with 11 deals under $10 million.

Billion-Dollar-Plus Medtech Deals

Announced in 2024

Source: LSI Market Intelligence

Large Players Divesting and Recalibrating

Rather than continuing to expand and diversify their product lines, in this past year some of the sector’s biggest players streamlined their business and concentrated their portfolios in high-growth areas. As a result, divestments have become a major theme of recent industry dealmaking, according to the EY report.

As one example, in June, Becton, Dickinson and Co. (BD) acquired Edwards Lifesciences’ Critical Care product group, focused on advanced monitoring solutions with advanced AI algorithms serving millions of patients globally, for $4.2 billion in cash, to enhance BD’s portfolio of smart connected care solutions. Prior to the acquisition, the Critical Care group had approximately 4,500 employees, with most based in Irvine, CA, and 2023 revenues totaling more than $900 million. For Edwards, the sale of Critical Care reflects the company’s sharpened focus as a structural heart innovator.

In August, Baxter International announced a definitive agreement under which global investment firm Carlyle will acquire Baxter’s Kidney Care segment, to be named Vantive, for $3.8 billion. Baxter first announced its intention to create a standalone kidney care company in January 2023, but a little over a year later, in March 2024, the company was in discussions to explore a potential sale of the segment. After reviewing the financial impact of potential separation pathways, management and the Baxter Board determined that selling the business to Carlyle should maximize value for Baxter stockholders and best position Baxter and Vantive for long-term success. Vantive offers products and services for peritoneal dialysis, hemodialysis, and organ support therapies, with more than 23,000 employees globally and 2023 revenues of $4.5 billion.

Fuel for Growth: Medtech Continues to Innovate

One reason to be positive about the industry’s underlying fundamentals going into 2025 is the record-breaking pace of new product FDA approvals. The FDA’s Center for Devices and Radiological Health (CDRH) noted in its 2023 Annual Report that it authorized 124 novel, firstof- their-kind devices in 2023 (excluding emergency use authorizations)—the highest on record in the Center’s history. CDRH continues to see high numbers of novel devices coming to market, with an almost five-fold increase in novel device authorizations since 2009.

The number of 510(k) approvals in 2023 rose for the fourth consecutive year, to reach a record 3,325, according to FDA, while pre-market approvals (PMAs) grew by a monumental 77% as review and approval timelines recovered from any lingering bureaucratic backlog following the COVID-19 public health emergency.

In another sign of an innovation-themed future ahead, in 2023, CDRH granted Breakthrough Device designation to 167 devices, and granted marketing authorization to 29 Breakthrough Devices. Since the launch of the Breakthrough Devices Program, the agency has granted this special status to 921 devices as of the end of 2023, including devices originally designated under the Expedited Access Pathway program that started in 2015.

Medtech is also progressing into bold new frontiers, as ongoing breakthroughs in artificial intelligence (AI) hold the promise of making devices smarter and more personalized.

The FDA’s Digital Health Center of Excellence continues to foster innovation for new and emerging digital health technologies, including AI-machine learning (AI-ML)-enabled devices. To date, CDRH has authorized over 700 AI/ML-enabled medical devices, and more are under development.

Look out for a review of CDRH’s upcoming 2024 annual report here in The Lens!

2025: Into the Great Wide Open

As we embark on a new year, the medtech landscape is brimming with momentum. As illustrated over the past few years, medtech M&A has charted a consistent and steady course, with 2024 bringing fresh gains in both venture investments and deal-making—a trajectory poised to soar even higher in the year ahead. The engines driving this growth include advancements in transformative technologies like AI, robust FDA support for innovative devices, the global challenge of an aging population, and the urgent demand for cost-effective healthcare solutions. These forces have solidified medtech as a magnet for strategic buyers and investors, positioning the sector as a hub of opportunity and innovation. The very real challenges coming from global economies, geopolitical uncertainties, healthcare system constraints, and rising competition, among other factors, will test the resiliency and persistence of all medtech players, but also offer opportunities and rewards for companies agile enough to innovate and align with shifting market demands.

Even amid expected turbulence, the medtech industry has exemplified remarkable innovation, keeping it firmly on a flight plan toward its goals of financial success and improved patient outcomes into 2025. The spirit of patient-centered innovation remains the industry’s jet fuel, and we can’t wait to see how the ecosystem will continue to soar to new heights to meet the evolving needs of patients.

17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy

Subscription Includes

Global Medtech Market Analysis & Projections (MAP), 2021-2031 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Surgical Procedure Volumes Dashboard, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

United States Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Aesthetics, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Cardio, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

ENT, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

General, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Neuro, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

OB/GYN, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Ophthalmology, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Orthopedic, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Peripheral Vascular, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spine, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

SRS, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Urological, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Global Markets for Hip Replacement Implants, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Guidewires, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Atherectomy Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Electrosurgery, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Balloons & Vena Cava Filter, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Mechanical Heart Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tissue Heart Valve Replacement, 2023-2028 Published:

2023 Next Update:

Q2 2030 Deliverables:

2023

Q2 2030

Global Markets for Transcatheter Mitral Valve Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Femoral Closure, 2023-2029 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tricuspid Valve Repair, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Percutaneous Pulmonary Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Coronary Angio Guidewires & Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Oncology Ablation Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for ENT Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Cell Delivery Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Urology Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for External Pain Pumps, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Ureteral Access Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Pelvic Floor Repair, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Atrial Fibrillation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neurovascular Devices Ischemic, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neuromodulation Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Vertebroplasty Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Benign Prostation Hyperplasia Implants, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Cryoablation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Diagnostic Electrophysiology Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Hernia Repair, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for CRM Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Neurovascular Devices Hemorrhagic, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Renal Denervation, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Upper+Lower Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Peripheral Stents, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electromagnetic Navigation Systems, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for GI Endoscopy, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Hemodialysis, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Globals Markets for Cardiac Ablation, 2023-2028 Published:

Next Update:

Deliverables:

Global Markets for Atrial Septal Occlusion, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Aortic Grafts, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Interventional Cardiology Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Oncology Embolization, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Vascular Access Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Rotator Cuff Repair Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electrical Stimulation Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Wearable Monitoring Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Low Complexity Medical Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Canada Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Germany Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

France Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

U.K. Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Italy Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spain Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Poland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Netherlands Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Belgium Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Sweden Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Switzerland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Denmark Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Finland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Norway Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

China Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

India Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Japan Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Korea Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Australia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Thailand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Malaysia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Singapore Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

New Zealand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Caribbean Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Argentina Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Colombia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Chile Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Guatemala Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Dominican Republic Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Costa Rica Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Panama Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Mexico Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Brazil Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Turkey Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Russia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Africa Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024