LSI's Medtech Startup Tracker is focused exclusively on covering the privately-held innovators changing the medical device landscape.

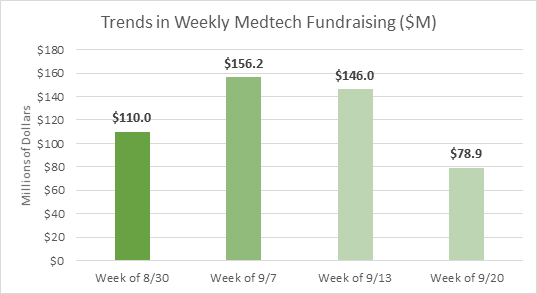

In this past week in medtech deals approximately $78.9M in funding was raised across 4 deals, in addition to other undisclosed deals that were announced. This is the lowest total amount of weekly funding tracked by LSI in nearly 4 weeks, with the last low of $85.5M seen for the week of August 23rd, 2021.

Below are some of the top deals tracked over the past week:

Start a Free Trial to Medtech Startup Tracker Today

Top Deals – Medtech Fundraising Transactions for the Week

Company | Type | Amount Raised | Round |

Digital surgery platform | $30,000,000 | Series C | |

Genetics testing platform | $25,000,000 | Series B | |

Data analysis and insights platform for neuroscience | $22,800,000 | Series A |

Top deals for the week are based on publicly available information. At this time of this article’s publication, new deals for the week may have been announced.

LSI'sMedtech Startup Tracker is focused exclusively on covering the innovators changing the medical device landscape. Here are some of the interesting startups we’ve recently profiled:

Caresyntax closes Series C round

The extended round allowed Caresytnax to pull in an additional $30M on top of the $100M that was raised in April 2021. Caresyntax’s digital surgery platform uses data and artificial intelligence (AI) to improve care delivery inside and outside of the operating room. The company’s platform provides benefits to multiple stakeholders, including surgeons, hospital administrators, medical device companies, and insurances companies. Caresyntax’s platform is utilized in over 4,000 operating rooms worldwide and supports over 2 million procedures per year. With this recent round of funding closed, the company has raised an estimated $208M.

evismo – remote patient monitoring solutions

evismo is developing cost-effective, patient focused solutions for remote vital signs monitoring. The company’s first product, CardioFlex, is a flexible wearable device that captures long-term ECG data to promptly diagnose patients with cardiac arrythmias. evismo plans to introduce new remote monitoring solutions for the diagnosis and prevention of other conditions. In September 2021, the Zurich-based company raised $1.1M in Seed funding. Key strategics in the remote patient monitoring market includeBoston Scientific,Medtronic, andPhilips.

Prenetics to go public via SPAC merger

The deal with special purpose acquisition company, Artisan Acquisition Corp, will value Prenetics at $1.25B, with a combined equity value of $1.7B. Prenetics has announced that proceeds from the deal will allow the genomic testing company to make strategic acquisitions that will make the company competitive in markets targeted by companies such as Exact Sciences and Invitae. According to Prenetics, the future of the company’s growth will revolve around the Circle HealthPod, the company’s home testing platform.Cue Health andQuidel are other competitors in the diagnostic testing market that believe the future of the market is home testing.

Vexev is developing a robotic ultrasound system for vascular imaging

Australian medtech startup Vexex emerged from stealth this week, revealing its tomographic ultrasound robot (TUR) system. The TUR system is being designed to automate the ultrasound process and address the limitations of current 2D ultrasound systems that are used in diagnosing cardiovascular diseases. Vexev’s device will allow vascular sonographers to obtain 3D images comparable to CT and MRI, while reducing the repetitive strain injuries that are common among sonographers. In September 2021, the company completed its first round of funding, closing a Seed round which raised $1.5M. Key strategics in the ultrasound market includeGE Healthcare,Philips, andSiemens.

Turn Medical – preventing pulmonary complications in immobile patients

Patients that are immobilized in the hospital due to pulmonary disorders (e.g. pneumonia, sepsis) are often at risk of experiencing further complications due to being in a supine position. While the benefits of adjusting these patients into the prone position is known, it is often difficult to place patients in this position due to a variety of barriers. Turn Medical has developed the Pronova-O2 system, an automated prone therapy system that removes these barriers and makes it safe and effective to automatically rotate immobilized patients. In September 2021, Turn Medical raised $2.4M in funding from a Seed round. Major strategics in the hospital beds and critical care market includeGetinge,Hill-Rom, andStryker.

Rune Labs raises $23M in Series A funding

RuneLabs is developing a cloud platform dedicated to compiling data from the brain for partners in pharmaceuticals and medtech. Data collected from brain imaging, medical devices (e.g. neuromodulation devices), electrophysiology, and wearables is analyzed and visualized to provide partners with insights that accelerate the development of the next generation of neurological solutions. Beyond partnering in the research and development space, Rune Labs platform can provide clinicians with brain data to support disease management and symptom tracking. According to Rune Labs, the investment will be used to hire additional software developers and build a neuroscience team that will attract new partners in pharmaceutical development.

Learn about the hottest venture funded startups developing innovative medical technologies using Life Science Intelligence’sMedtech Startup Tracker.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy

Subscription Includes

Global Medtech Market Analysis & Projections (MAP), 2021-2031 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Surgical Procedure Volumes Dashboard, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

United States Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Aesthetics, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Cardio, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

ENT, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

General, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Neuro, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

OB/GYN, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Ophthalmology, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Orthopedic, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Peripheral Vascular, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spine, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

SRS, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Urological, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Global Markets for Hip Replacement Implants, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Guidewires, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Atherectomy Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Electrosurgery, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Balloons & Vena Cava Filter, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Mechanical Heart Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tissue Heart Valve Replacement, 2023-2028 Published:

2023 Next Update:

Q2 2030 Deliverables:

2023

Q2 2030

Global Markets for Transcatheter Mitral Valve Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Femoral Closure, 2023-2029 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tricuspid Valve Repair, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Percutaneous Pulmonary Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Coronary Angio Guidewires & Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Oncology Ablation Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for ENT Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Cell Delivery Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Urology Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for External Pain Pumps, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Ureteral Access Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Pelvic Floor Repair, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Atrial Fibrillation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neurovascular Devices Ischemic, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neuromodulation Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Vertebroplasty Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Benign Prostation Hyperplasia Implants, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Cryoablation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Diagnostic Electrophysiology Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Hernia Repair, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for CRM Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Neurovascular Devices Hemorrhagic, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Renal Denervation, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Upper+Lower Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Peripheral Stents, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electromagnetic Navigation Systems, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for GI Endoscopy, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Hemodialysis, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Globals Markets for Cardiac Ablation, 2023-2028 Published:

Next Update:

Deliverables:

Global Markets for Atrial Septal Occlusion, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Aortic Grafts, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Interventional Cardiology Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Oncology Embolization, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Vascular Access Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Rotator Cuff Repair Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electrical Stimulation Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Wearable Monitoring Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Low Complexity Medical Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Canada Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Germany Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

France Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

U.K. Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Italy Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spain Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Poland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Netherlands Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Belgium Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Sweden Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Switzerland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Denmark Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Finland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Norway Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

China Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

India Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Japan Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Korea Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Australia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Thailand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Malaysia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Singapore Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

New Zealand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Caribbean Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Argentina Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Colombia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Chile Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Guatemala Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Dominican Republic Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Costa Rica Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Panama Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Mexico Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Brazil Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Turkey Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Russia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Africa Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024