Life Science Intelligence’s Weekly Medtech Pro Review provides a preview of select market data and startups covered in the full Medtech Pro Platform, which is a comprehensive market intelligence solution for medtech executives. As a preview of the types of content found on Medtech Pro, the Weekly Medtech Pro Review will cover select market data, procedure volumes, and startups.

Click here to learn more or subscribe to the full Medtech Pro platform.

Medtech Market Snapshot – Inferior Vena Cava Filters

Pulmonary embolism (PE) carries a significant risk of morbidity and mortality if not caught and treated promptly. According to the CDC, as many as 900,000 Americans are affected by deep vein thrombosis (DVT)/PE annually, with 10 to 30% of these individuals dying within a month of diagnosis. Individuals known to be at risk for the development of DVT/PE may have an inferior vena cava (IVC) filter placed to trap large blood clots from reaching the heart and lungs.

According to market data from LSI, the market for IVC filters has been on the decline since 2010 due to complications with these types of devices. In 2020, global sales attributable to IVC filters were approximately $334M. While the COVID-19 pandemic impacted the IVC market, a rebound effect due to delayed procedures is projected to occur in 2021, somewhat slowing the decline in sales. As a result of this slight pandemic-induced rebound, total sales of IVC filters are projected to reach $330.1M in 2021.

For more market data on the global IVC filters market, as well as other medtech markets, visit LSI’s Medtech Pro platform.

Surgical Procedure Volumes – Cataract Surgery in Japan

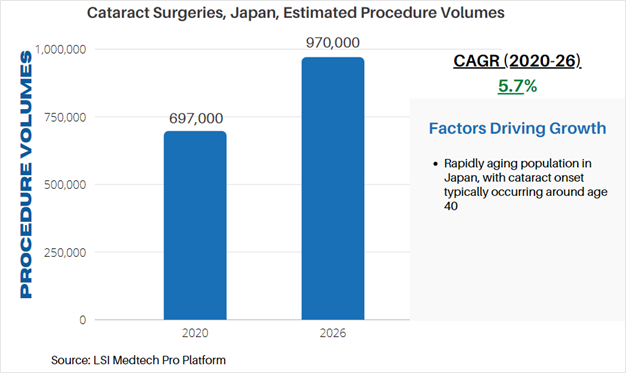

Life Science Intelligence tracks surgical procedure volumes across 37 countries and 12 major surgical markets (e.g. orthopedics, ENT, aesthetics). This week, our featured surgical procedure volume is for cataract surgeries in Japan. Cataract surgery involves the replacement of the natural lens of the eye with an intraocular lens (IOLs). The procedure is performed to remove cataracts which cause blurring of vision due to changes in the proteins found in the lens of the eye.

According to LSI’s Surgical Procedure Volumes database there were an estimated 697,000 of these procedures performed in 2020, which represented a significant decline from estimated procedure volumes in 2019. While many elective surgeries were cancelled due to the COVID-19 pandemic, cataract procedure volumes sharply are projected to quickly recover in 2021. This recovery will also be driven by rescheduled procedures which were halted or cancelled due to COVID-19. Following this recovery, LSI projects that cataract surgeries will stabilize and continue to follow demographic changes – chiefly the aging of the global population. By 2026, cataract surgery volumes will exceed 970,000 annual procedures in Japan.

Startup Spotlight

To see a Proximie’s presentation at the LSI Emerging Medtech Summit, click here.

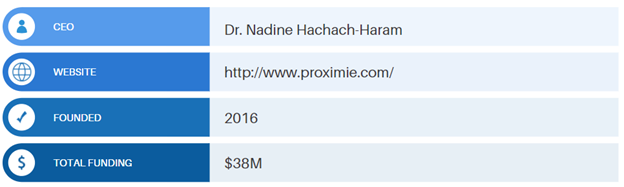

Proximiewas created to allow surgeons throughout the world to connect and collaborate. To realize this goal, the company has developed a technology platform that leverages augmented reality (AR) to allow surgeons to mentor and “scrub in” with other clinicians, medtech personnel, and other healthcare experts. The result of this effort is a democratized, borderless operating room that digitizes the surgical process.

According to Proximie, the benefit of their platform is twofold. First, clinicians can mentor and guide other physicians, broadening access to clinical experience despite traditional barriers such as cost and accessibility. Second, doctors and healthcare experts can virtually join procedures and collaborate using augmented reality to interact with procedure images (e.g. identifying high risk lesions in a vessel) and demonstrate surgical techniques. In a post-COVID-19 world, where access to customers and patients is restricted, Proximie’s technology allows other physicians and medtech reps to engage and support other healthcare providers, without increasing risks.

Since the company’s founding in 2016, over 10,000 assistive procedures have been performed globally using the company’s platform.

In April 2021, the company completed a Series B round of fundraising, raising $38M. The investment will help Proximie commercialize their platform in the US and Europe and to continue research and development of their collaborative platform software.

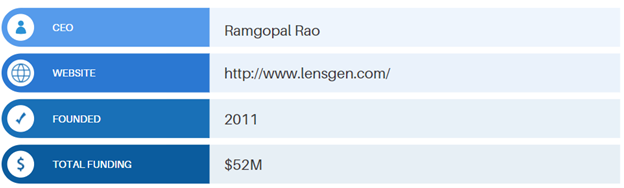

Life Science Intelligence is proud to announce that LensGenwill be a presenting at the 2022 Emerging Medtech Summit in Dana Point, California.

LensGen is a clinical-stage ophthalmic medtech company developing Juvene, a biomimetic, curvature changing fluid optic IOL for the treatment of cataracts and presbyopia.

Once placed, the Juvene IOL can adjust dioptric power by using the body’s natural muscles that control contractions within the eye. Placement of lens follows the conventional cataract surgical procedure. Juvene is a next-generation approach to the treatment of cataracts, which have traditionally relied on monofocal, multifocal, or Toric IOLs. The major drawback to these types of IOLs is that they do not simultaneously restore near and distant vision, requiring patients to wear glasses. While multifocal lenses slightly addressed this limitation, they still have “breaks” in focus power.

Johnson & Johnson’s Tecnis Symfony IOL does offer an alternative to multifocal lenses with its unique diffractive design; however, the IOL only extends the range of continuous vision clarity and does not mimic a natural lens as LensGen’s technology aims to achieve.

In late August 2021, the company announced that it had raised $10M in a $20M Bridge Financing round. This latest round of fundraising brings the total amount of funding raises by LensGen to approximately $52M.

Humacyteis a clinical-stage biotechnology dedicated to the development of off-the-shelf, universally implantable bioengineered human tissue for the treatment of complex organ disease.

The company’s Human Acellular Vessel (HAV), Humacyl, is a regenerative vascular conduit being investigated for multiple vascular applications, including vascular reconstruction, repair, and replacement. Humacyl is grown by seeding vascular cells into a biocompatible, biodegradable polymer mesh in a bioreactor bag. As the vessel forms, the polymer mesh degrades, and the vessel is decellularized to create the HAV.

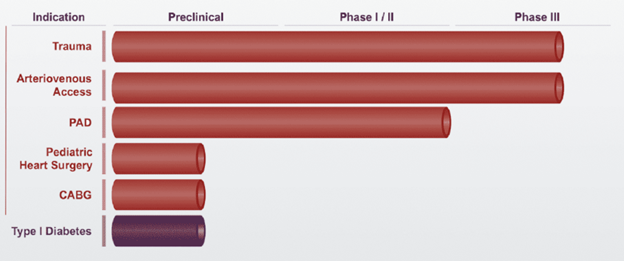

Humacyte currently has two ongoing Phase 3 clinical trials investigating Humacyl for trauma and arteriovenous access. The FDA granted Humacyte a Regenerative Medicine Advanced Therapy (RMAT) designation in March 2017 with the aims of expediting its regulatory approval in the US. Humacyte is also conducting late-stage trials in Europe and is seeking to file for regulatory approval in the US and Europe.

Figure 1: Humacyte's development pipeline for HAV

On August 27th, 2021, Humacyte went public through a merger with special purpose acquisition company (SPAC) Alpha Healthcare Acquisition Corp. Fresenius Medical Care, a major strategic in the renal diseases products and services market, has a $175M stake in Humacyte. Fresenius has obtained exclusive rights to commercialize Humacyl outside of the US. Including Fresenius’ significant investment in the company, Humacyte has raises over $500M in funding.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy

Subscription Includes

Global Medtech Market Analysis & Projections (MAP), 2021-2031 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Surgical Procedure Volumes Dashboard, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

United States Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Aesthetics, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Cardio, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

ENT, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

General, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Neuro, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

OB/GYN, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Ophthalmology, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Orthopedic, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Peripheral Vascular, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spine, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

SRS, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Urological, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Global Markets for Hip Replacement Implants, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Guidewires, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Atherectomy Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Electrosurgery, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Balloons & Vena Cava Filter, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Mechanical Heart Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tissue Heart Valve Replacement, 2023-2028 Published:

2023 Next Update:

Q2 2030 Deliverables:

2023

Q2 2030

Global Markets for Transcatheter Mitral Valve Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Femoral Closure, 2023-2029 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tricuspid Valve Repair, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Percutaneous Pulmonary Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Coronary Angio Guidewires & Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Oncology Ablation Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for ENT Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Cell Delivery Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Urology Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for External Pain Pumps, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Ureteral Access Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Pelvic Floor Repair, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Atrial Fibrillation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neurovascular Devices Ischemic, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neuromodulation Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Vertebroplasty Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Benign Prostation Hyperplasia Implants, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Cryoablation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Diagnostic Electrophysiology Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Hernia Repair, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for CRM Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Neurovascular Devices Hemorrhagic, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Renal Denervation, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Upper+Lower Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Peripheral Stents, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electromagnetic Navigation Systems, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for GI Endoscopy, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Hemodialysis, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Globals Markets for Cardiac Ablation, 2023-2028 Published:

Next Update:

Deliverables:

Global Markets for Atrial Septal Occlusion, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Aortic Grafts, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Interventional Cardiology Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Oncology Embolization, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Vascular Access Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Rotator Cuff Repair Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electrical Stimulation Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Wearable Monitoring Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Low Complexity Medical Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Canada Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Germany Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

France Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

U.K. Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Italy Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spain Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Poland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Netherlands Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Belgium Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Sweden Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Switzerland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Denmark Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Finland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Norway Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

China Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

India Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Japan Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Korea Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Australia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Thailand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Malaysia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Singapore Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

New Zealand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Caribbean Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Argentina Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Colombia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Chile Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Guatemala Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Dominican Republic Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Costa Rica Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Panama Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Mexico Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Brazil Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Turkey Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Russia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Africa Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024