Life Science Intelligence’s Weekly Medtech Pro Review provides a preview of select market data and startups covered in the full Medtech Pro Platform, which is a comprehensive market intelligence solution for medtech executives. As a preview of the types of content found on Medtech Pro, the Weekly Medtech Pro Review will cover select market data, procedure volumes, and startups.

Click here to learn more or subscribe to the full Medtech Pro platform.

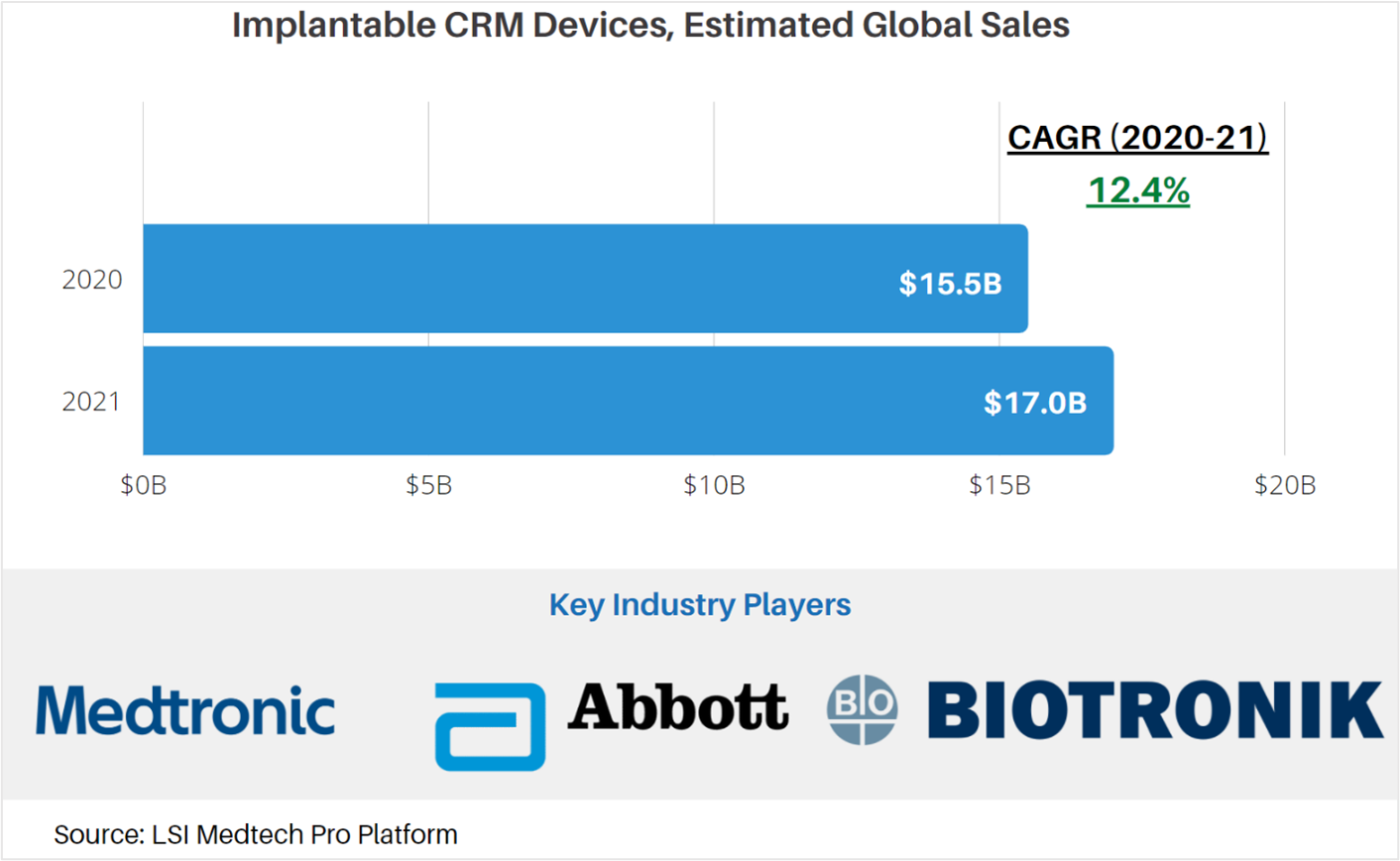

Medtech Market Snapshot – Implantable CRM Devices

Cardiac rhythm management (CRM) devices are used to correct and manage cardiac arrhythmias. Implantable devices used for the management of arrythmia include pacemakers, implantable cardioverter defibrillators (ICDs) and cardiac resynchronization therapy (CRT) devices. These devices are designed to treat the many different types of arrythmia.

According to market data from LSI, global sales attributable to implantable CRM were approximately $15.5B. Due to the impact of the COVID-19 pandemic on the healthcare system in 2020, a surplus of procedures that were rescheduled or cancelled will be

The market for these devices is projected to increase at a CAGR of 5.2% to $17.0M in 2021. Total product sales are anticipated to see a mild rebound in 2021 in response to slowed growth during the outbreak of the COVID-19 pandemic. Following this rebound, sales of drug delivery devices will stabilize and taper over the next 4 years.

LSI’s analysis of the drug delivery devices market encompasses sales of injection devices, infusion pumps, and related administration sets. It excludes the sales of orally administered therapeutic agents, depot and transdermal drugs, and implantable pain pumps.

For more market data on the global implantable CRM devices market, as well as other medtech markets, visit LSI’s Medtech Pro platform.

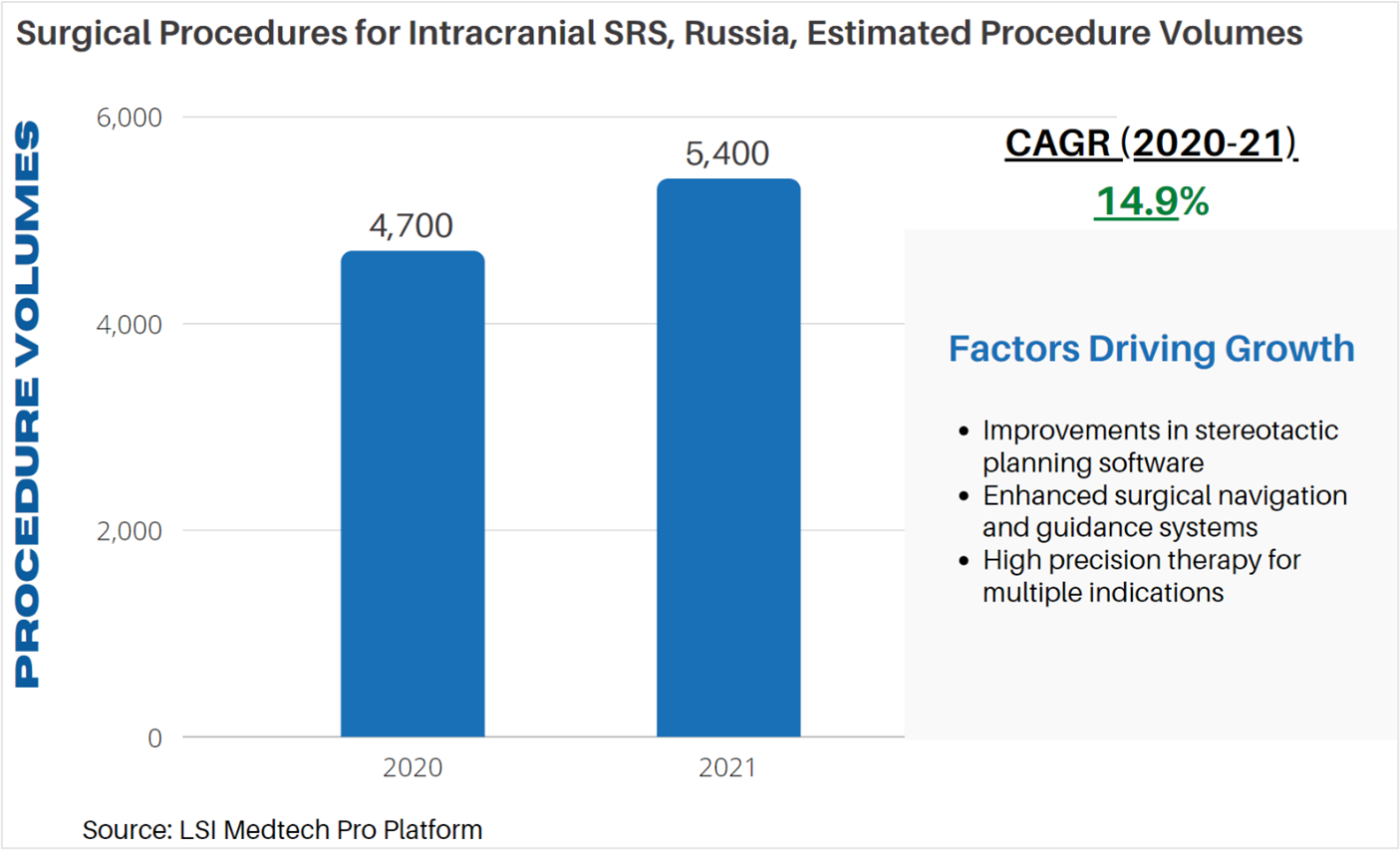

Surgical Procedure Volumes – Intracranial SRS in Russia

Life Science Intelligence tracks surgical procedure volumes across 37 countries and 12 major surgical markets (e.g. orthopedics, ENT, aesthetics). This week, our featured surgical procedure volume is for intracranial stereotactic radiosurgery (SRS) procedures in Russia. Stereotactic radiosurgery focuses tiny beams of radiation to create or obliterate a lesion, without requiring open surgery (i.e. surgical incision). The technique is often used as a high precision treatment method for tumors, vascular malformations, and abnormalities of the brain. Types of SRS include charged particle methods, Gamma Knife, and linear accelerators.

According to LSI’s Surgical Procedure Volumes database there were an estimated 4,700 intracranial SRS procedures performed in 2020 in Russia. The country’s response to the COVID-19 pandemic was similar to many other nations, with the Russian government implementing preventative measures to slow the spread of the coronavirus. While SRS is typically considered to be an elective procedure, indications for urgent procedures are easily identified. LSI projects that the impact of COVID-19 on intracranial SRS procedure volumes has thus far been negligible. In 2021, an estimated 5,400 intracranial SRS procedures are anticipated to be performed in Russia. At this time, the impact of the Delta variant on intracranial SRS procedure volumes is believed to be minimal.

Startup Spotlight

To see a AtriAN Medical’s presentation at the LSI Emerging Medtech Summit, click here.

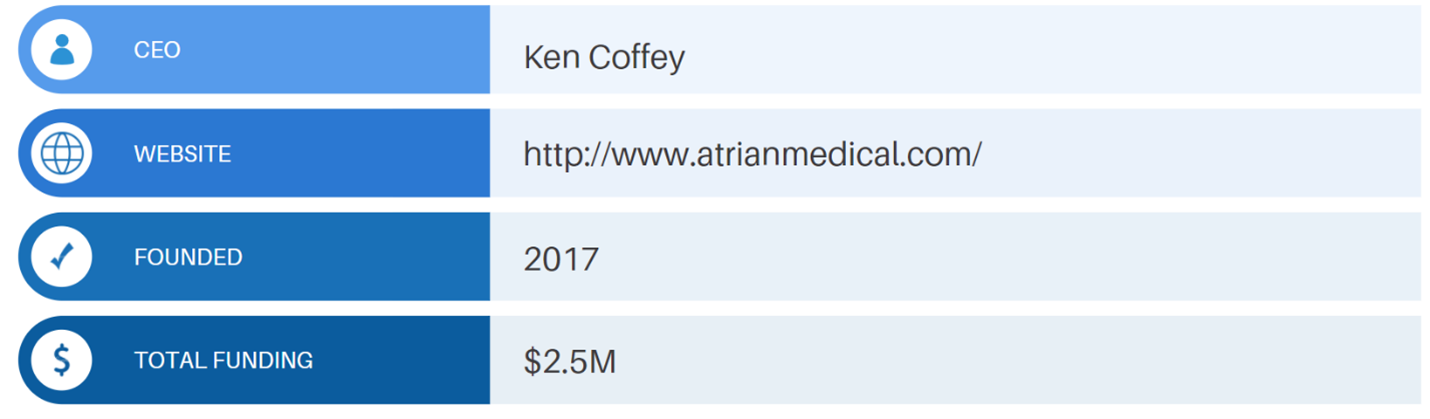

AtriAN Medical is developing a next generation solution for the treatment of atrial fibrillation. Current ablation solutions utilize thermal-based techniques to ablate tissue. These techniques can cause damage to surrounding healthy tissues and can fail to completely resolve errant electrical signals over time.

To address the limitations of current techniques, AtriAN Medical is developing a targeted, non-thermal approach that uses micro Pulsed Electrical Fields (mPEF) to ablate neuronal cells in clusters known as ganglionated plexi (GPs). This approach to targeting the hyperactive cells on the exterior surface of the heart, sparing the myocardium. According to AtriAN, their cardioneuroblation technique will be a more precise and gentle option for the millions of adults living with AF.

Figure 1: AtriAN Medical’s mPEF console

In June 2015, AtriAN Medical was selectedas one of the 50 startups selected for MedtTech Innovators accelerator program.

AtriAN Medical has raised $2.5M in funding, with the most recent funding round being a Seed round that closed in October 2019.

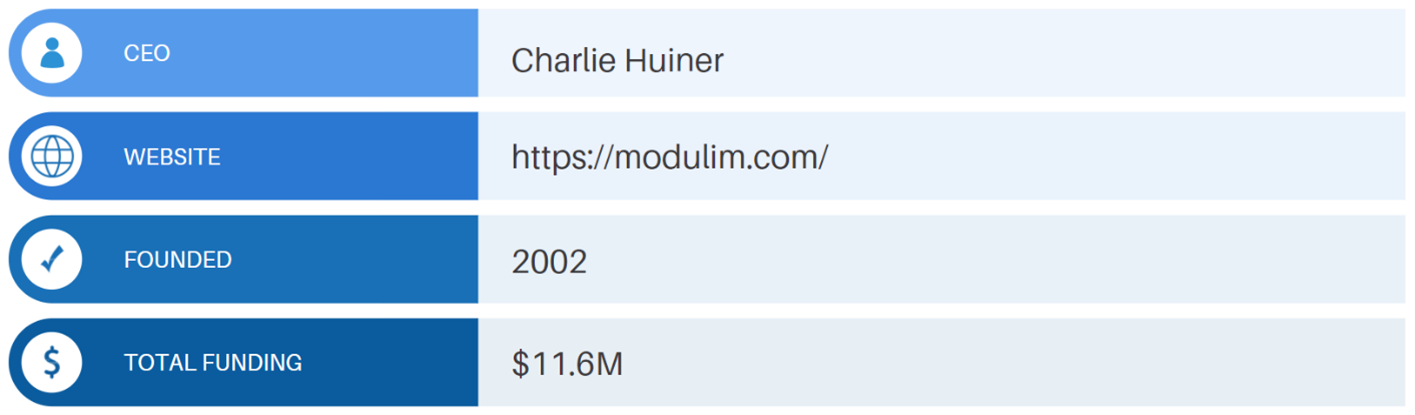

Life Science Intelligence is proud to announce that Modulimwill be a presenting at the 2022 Emerging Medtech Summit in Dana Point, California.

Limb loss is a serious complication associated with chronic kidney disease, diabetes, and peripheral arterial disease (PAD). Early identification and quantification of progression of microvascular dysfunction is key to preventing loss of limb. Modulim has developed a solution to provide clinicians with a point-of-care assessment of microcirculation that facilitates early intervention of microvascular dysfunction.

The company’s Clarifi system is a noninvasive diagnostic that rapidly assesses and quantifies five hemoglobin biomarkers of oxygenation and perfusion. To achieve this assessment of biomarkers, the Clarifi system utilizes a proprietary optical imaging technique called spatial frequency domain imaging (SFDI). The technique provides a quantitative measurement of tissue oxygen availability, extraction, and saturation using visible and near-infrared light and proprietary computational modeling to quantify hemoglobin distribution and oxygenation.

The Clarifi system received 510(k) clearance from the FDA in July 2018. The company has raised approximately $12M in total funding. Accordingto Modulim, investments in the company have largely supported commercialization of the company’s imaging system.

Figure 2: Modulim’s Clarifi system

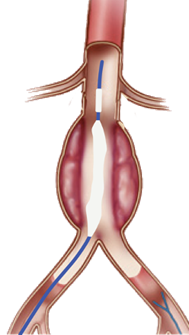

The origin of Nectero Medical’s name is the Latin word nectere, which means to bind, connect, interweave. In living up to the company’s namesake, Nectero is developing a proprietary technology to bind and stabilize abdominal aortic aneurysms (AAAs).

According to Nectero, there are currently over one million patients in the US with an AAA at risk of rupture that is unable to be treated with current methods. According to a studyof 9,457 in patients in the US, the prevalence of AAA is approximately 3% in adults ages 65 to 75. The slow growing nature of AAAs can make them difficult to detect, thought routine screening (annual or semi-annual imaging) of at-risk adults can help to identify AAAs. Aneurysms at risk of rupture require open or minimally invasive surgery. Endovascular aneurysm repair (EVAR) is the most common technique used today for the treatment of AAA, though the technique has many procedure and device related risks.

Nectero Medical’s Endovascular Aneurysm Stabilization Treatment (EAST) system is a minimally invasive alternative to EVAR. The EAST system is comprised of the Stabilizer Delivery Catheter and proprietary Stabilizer Compound. The Stabilizer Compound is diffused into the aneurysm wall and binds with degraded elastin and collagen, increasing tissue strength and reducing the risk of rupture.

Figure 3: Example of Nectero Medical’s EAST system to treat AAA

Initial clinical experience with the EAST system shows that the procedure can be performed in under an hour, compared to the 3 to 4 hours required to perform EVAR. Due to a device not being implanted, Nectero Medical’s solution avoids the device-based complications associated with current treatment options.

The company has raised over $20M in funding, with Boston Scientific being a major investor in Nectero.

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy

Subscription Includes

Global Medtech Market Analysis & Projections (MAP), 2021-2031 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Surgical Procedure Volumes Dashboard, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

United States Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Aesthetics, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Cardio, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

ENT, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

General, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Neuro, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

OB/GYN, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Ophthalmology, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Orthopedic, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Peripheral Vascular, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spine, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

SRS, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Urological, Global Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Global Markets for Hip Replacement Implants, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Guidewires, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Atherectomy Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Electrosurgery, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Peripheral Vascular Balloons & Vena Cava Filter, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Mechanical Heart Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tissue Heart Valve Replacement, 2023-2028 Published:

2023 Next Update:

Q2 2030 Deliverables:

2023

Q2 2030

Global Markets for Transcatheter Mitral Valve Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Femoral Closure, 2023-2029 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Tricuspid Valve Repair, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Percutaneous Pulmonary Valves, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Coronary Angio Guidewires & Catheters, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Oncology Ablation Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for ENT Devices, 2023-2028 Published:

2023 Next Update:

Q2 2024 Deliverables:

2023

Q2 2024

Global Markets for Cell Delivery Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Urology Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for External Pain Pumps, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Ureteral Access Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Pelvic Floor Repair, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Atrial Fibrillation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neurovascular Devices Ischemic, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Neuromodulation Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Vertebroplasty Devices, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Benign Prostation Hyperplasia Implants, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Cryoablation, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Diagnostic Electrophysiology Catheters, 2023-2028 Published:

2023 Next Update:

Q3 2024 Deliverables:

2023

Q3 2024

Global Markets for Hernia Repair, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for CRM Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Neurovascular Devices Hemorrhagic, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Renal Denervation, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Upper+Lower Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Peripheral Stents, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electromagnetic Navigation Systems, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for GI Endoscopy, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Hemodialysis, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Globals Markets for Cardiac Ablation, 2023-2028 Published:

Next Update:

Deliverables:

Global Markets for Atrial Septal Occlusion, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Aortic Grafts, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Interventional Cardiology Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Oncology Embolization, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Vascular Access Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Rotator Cuff Repair Suture Anchors, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Electrical Stimulation Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Wearable Monitoring Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Global Markets for Low Complexity Medical Devices, 2023-2028 Published:

2023 Next Update:

Q4 2024 Deliverables:

2023

Q4 2024

Canada Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Germany Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

France Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

U.K. Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Italy Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Spain Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Poland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Netherlands Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Belgium Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Sweden Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Switzerland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Denmark Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Finland Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Norway Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

China Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

India Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Japan Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Korea Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Australia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Thailand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Malaysia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Singapore Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

New Zealand Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Caribbean Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Argentina Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Colombia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Chile Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Guatemala Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Dominican Republic Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Costa Rica Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Panama Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Mexico Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Brazil Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Turkey Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

Russia Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024

South Africa Surgical Procedure Volumes, 2018-2029 Published:

2022 Next Update:

Q2 2024 Deliverables:

2022

Q2 2024