Overview

Valued at

~$196 million in 2023, the cryoablation devices market is projected to reach

~$275 million by 2028, increasing at a

CAGR of 7.0% over the 2023-2028

forecast period. This Market Snapshot is part of

LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Cryoablation is the targeted freezing of tissue to produce selective cellular necrosis. The technology is used

as an alternative to other thermal-based approaches due to its reduced side effect profile in some indications.

Cryoablation devices are utilized for several indications, including:

Kidney tumors (e.g., small renal cell carcinomas)

Liver tumors (e.g., hepatocellular carcinoma, liver metastases)

Bone tumors (e.g., metastatic bone lesions for pain relief and stabilization)

Lung tumors (e.g., early-stage non-small cell lung cancer and pulmonary metastases)

Prostate tumors (e.g., localized prostate cancer treated as either a primary or salvage therapy)

Skin lesions

Peripheral vascular disease

Products included within the scope of this analysis include:

Cryoablation devices (excluding those indicated for cardiac ablation)

This Market Snapshot is intended to provide a high-level overview of the global market for cryoablation devices,

with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Cryoablation Devices Market Snapshot Summary

| Snapshot Aspect |

Data and Details |

| Base Year for Estimate |

2023 |

| Forecast Period |

2023 - 2028 |

| Market Size in 2023 |

$196 million |

| CAGR |

7.0% |

| Projected Market Size in 2028 |

$275 million |

Cryoablation Devices Market Insights

The cryoablation devices market is driven by several key trends, including the rising incidence of

cancer—particularly liver, prostate, and kidney cancers—as well as increasing rates of skin lesions, such as

melanoma and non-melanoma skin cancers. Other contributing factors include the prevalence of menorrhagia, driven

by the size of the female childbearing population, and the growing incidence of conditions like Barrett's

Esophagus.

Cryoablation's adoption is expected to continue growing as more healthcare providers and patients opt for this

minimally invasive treatment option. The broadening scope of its clinical applications further contributes to

its appeal, expanding its use beyond cancer treatments to address other medical conditions.

Despite these growth drivers, pricing pressures remain a significant challenge, with more than 15 companies

competing in the global cryoablation device market. Additionally, reimbursement rate constraints and

government-led efforts to reduce healthcare spending contribute to declining prices. However, the increased

adoption of cryoablation therapies is expected to counter these pressures and sustain market growth.

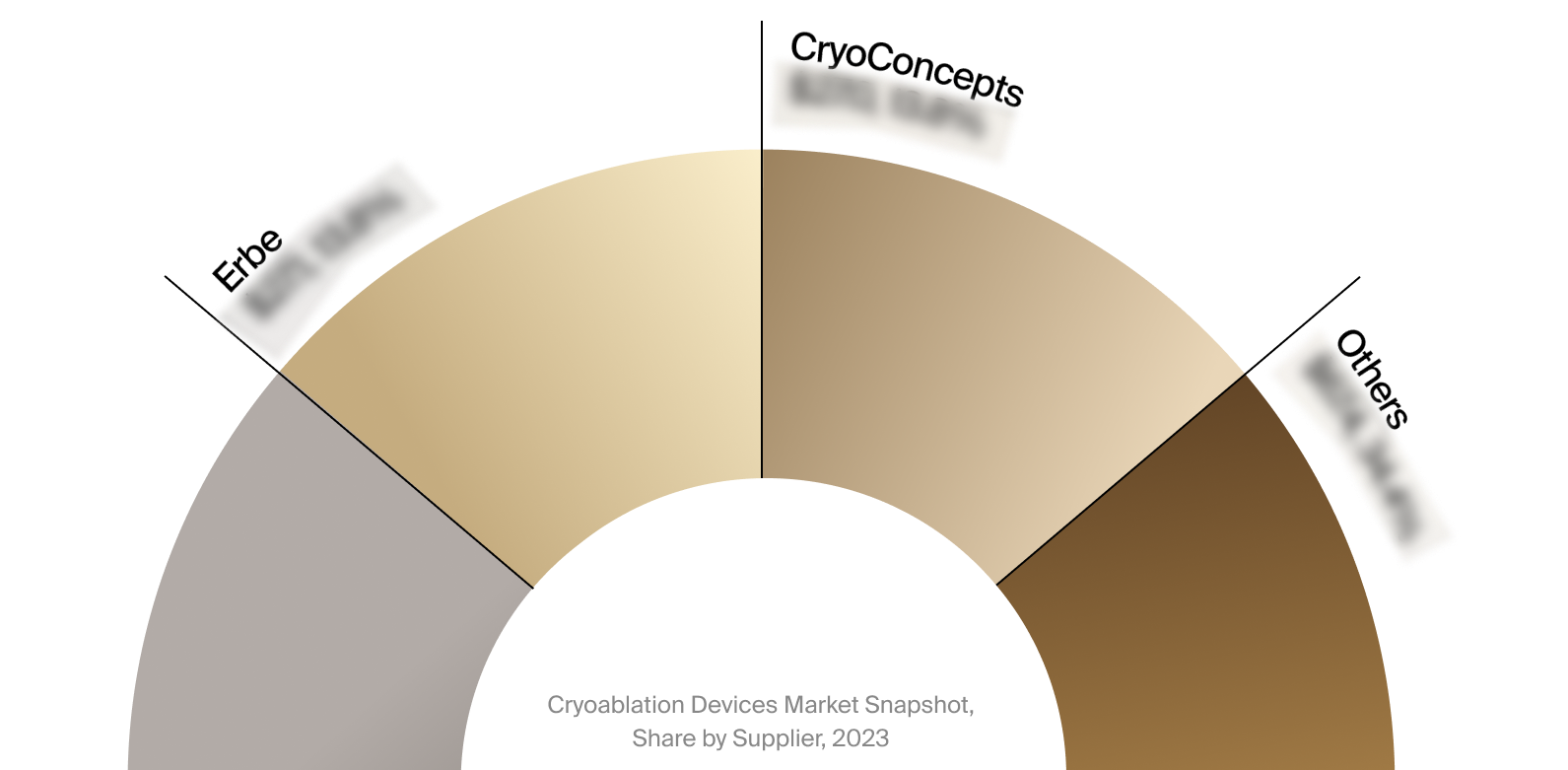

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the cryoablation devices

market. This includes estimated market revenue and market share for key players, such as Boston Scientific,

CryoConcepts, and Erbe.

Select Market Events

|

Company

|

Date

|

Event Type

|

Event

|

|

|

1/2024

|

Strategic Partnership

|

Varian and Nova Scotia Health formed a 10-year, Can$175 million multidisciplinary oncology

partnership.

|

|

|

4/2024

|

Product Launch

|

AtriCure announced the launch of the cryoSPHERE+ Probe for postoperative pain management.

|

Key Companies Covered

AtriCure

Boston Scientific

Brymill Cryogenic Systems

CooperSurgical

CryoConcepts

Cryoprobe

CryoSurgery

Endocare

Erbe

Grand Cryo

IceCure Medical

Mectronic Medicale

Varian