Overview

Valued at ~$18.7 billion in 2023, the drug delivery devices market is projected to reach

~$24.6 billion by 2028, increasing at a CAGR of 5.7% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Drug delivery devices are used ubiquitously throughout the healthcare system. They are utilized in various

settings, from hospitals administering drugs and fluids in hospitalized patients to delivering medications to

individuals with chronic conditions in nursing homes.

Products included within the scope of this analysis include:

Injection devices (e.g., syringes, pens, jet injectors)

Infusion pumps & sets

Gravity administration sets

Vascular access catheters (e.g., central & midline catheters)

Enteral solutions (i.e., drug delivery into the stomach)

External insulin pumps, including tethered and patch insulin pumps and sets

*Note: This analysis specifically excludes orally administered agents, depot and transdermal drugs, and

implantable pain pumps.

This Market Snapshot is intended to provide a high-level overview of the global market for drug delivery

devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Drug Delivery Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $18.7 billion |

| CAGR | 5.7% |

| Projected Market Size in 2028 | $24.6 billion |

Drug Delivery Devices Market Insights

The drug delivery devices market is experiencing growth due to increased drug delivery procedure volumes

combined with increases in price at slightly less than the rate of medical device price inflation. Growth in

drug delivery device utilization is largely driven by the adoption of newer biological drugs that necessitate

intravenous administration over oral routes. Additionally, there has been increased adoption of newer,

higher-priced smart pumps that help reduce medication errors and automate drug administration documentation,

resulting in higher dollar volume sales.

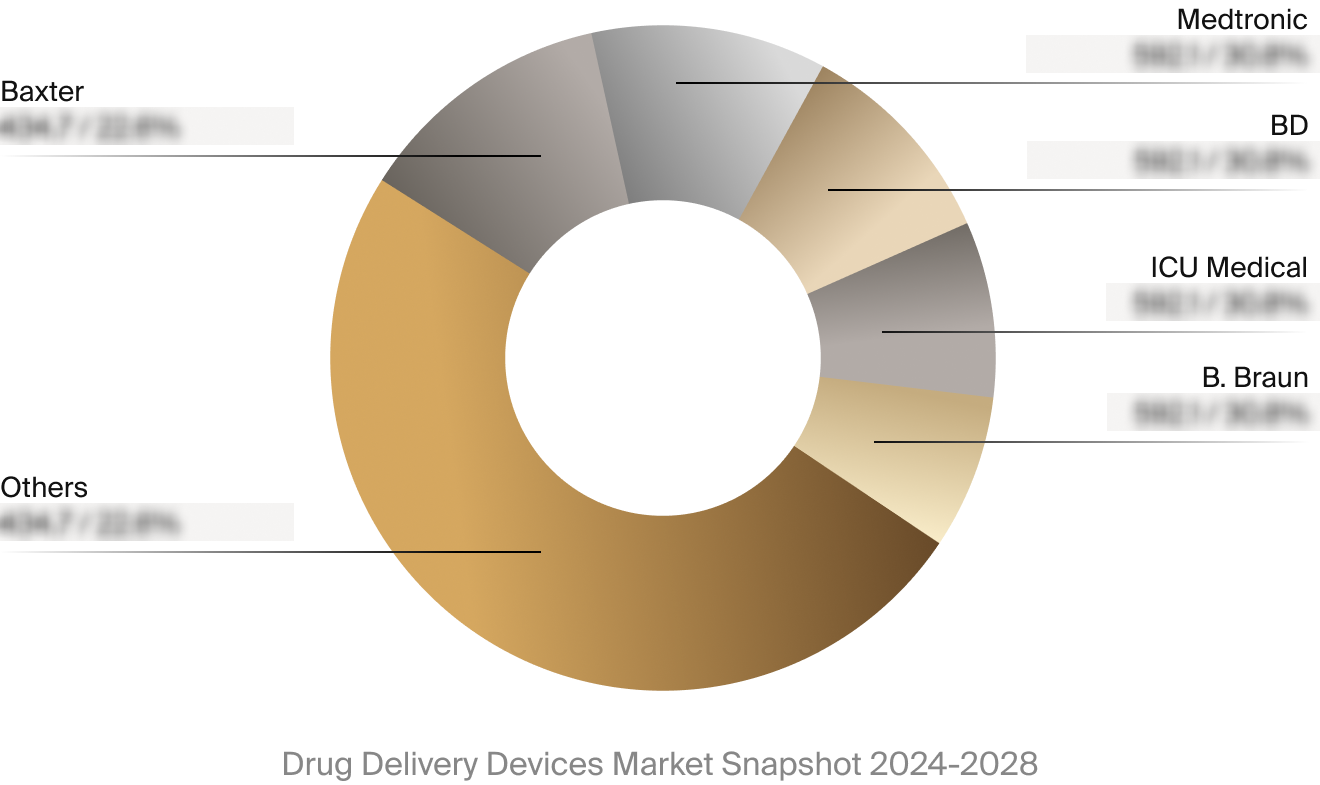

Leading suppliers, such as Medtronic, Baxter, and BD, collectively represented about 48% of the market share in

2023. Notably, ICU Medical increased its share from 5% in 2020 to 8.6% by acquiring Smith Medical's drug

delivery business.

Despite the market’s growth potential, it faces changes—particularly regarding regulatory oversight and

technological reliability. Many smart infusion systems have encountered recalls due to issues such as improper

medication administration and cybersecurity vulnerabilities. The market remains fragmented, with no single

company holding more than 20% market share, creating opportunities for smaller players to introduce innovative

technologies.

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the drug delivery devices

market. This includes estimated market revenue and market share for key players, such as Medtronic, Baxter, and

BD.

Select Market Events

| Company | Date | Event Type | Event |

|

BD

|

9/2024 | M&A | BD acquired Critical Care from Edwards Lifesciences. |

|

Baxter

|

4/2024 | Regulatory | Baxter received FDA 510(k) clearance for its Novum IQ™ large volume infusion pump (LVP) with Dose IQ™ Safety Software. |

Key Companies Covered

Ace Medical

Ambu

Avanos

Avid Medical

Baxter

B. Braun

BD

Cane

ICU Medical

Infutronix

Iradimed

Laborie Medical

Medtronic

MicroPort Scientific

Moog

Nouvag

Stradis

Teleflex

Walkmed

Zyno Medical