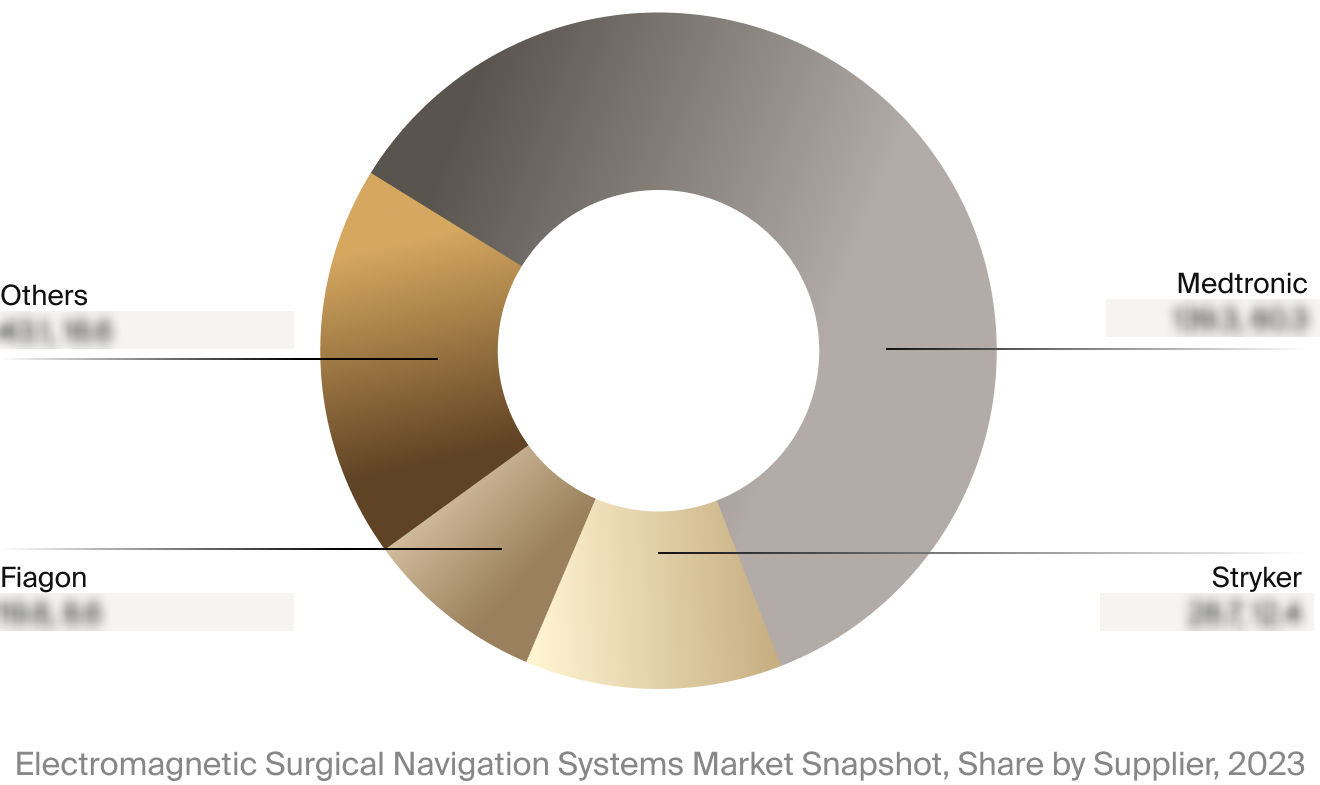

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $230.9 million |

| CAGR | 3.3% |

| Projected Market Size in 2028 | $271.4 million |

| Company | Date | Event Type | Event |

|

Medtronic

|

9/2023 | Product Recall | Medtronic initiated a Class I recall of the StealthStation S8 due to a software glitch causing the surgical plan data to shift to a different location outside the surgical site. There have been no reported injuries or deaths. |

|

Olympus

|

9/2023 | Product Discontinuation | Olympus announced the discontinuation of the manufacture and sale of Veran Medical Technology electromagnetic navigation systems due to quality issues. |

Trusted By The Companies Pioneering What’s Next

Market Intelligence

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy