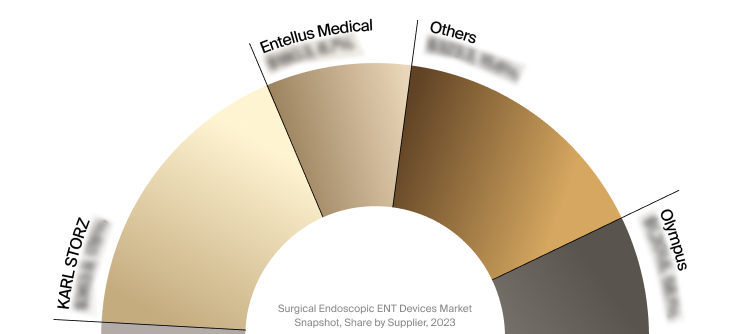

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $2.07 billion |

| CAGR | 3.8% |

| Projected Market Size in 2028 | $2.49 billion |

| Company | Date | Event Type | Event |

|

Olympus

|

5/2024 | Product Launch | Olympus announced the availability of its new DVM-B2 Digital Video Monitor, which can be used with single-use endoscopes for bronchoscopy and ENT. |

|

KARL STORZ

|

7/2023 | M&A | Karl Storz announced its acquisition of AventaMed, strengthening its ENT portfolio. |

Trusted By The Companies Pioneering What’s Next

Market Intelligence

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2025 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy