Overview

Valued at ~$11.7 billion in 2023, the hemodialysis consumables market is projected to reach

~$14.2 billion by 2028, increasing at a CAGR of 3.9% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

The hemodialysis consumables market encompasses products employed in the treatment and management of two major

conditions:

Acute kidney injury (AKI)

End-stage renal disease (ESRD)

Hemodialysis catheters provide access to the patient’s blood, while dialyzers are filters that remove waste from

blood using a dialysis solution and return the filtered blood to the body.

Products included within the scope of this analysis include:

Dialyzers

Hemodialysis catheters

This Market Snapshot is intended to provide a high-level overview of the global market for dialyzers and

hemodialysis catheters, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Hemodialysis Consumables Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $11.7 billion |

| CAGR | 3.9% |

| Projected Market Size in 2028 | $14.2 billion |

Hemodialysis Consumables Market Insights

The hemodialysis consumables market is positioned for continued growth, primarily driven by the rising

prevalence of ESRD and the increasing global burden of diabetes and hypertension. With over 4.1 million patients

receiving dialysis treatments worldwide, of which 89% are undergoing hemodialysis, the demand for effective

renal replacement therapies is higher than ever. According to the U.S. Renal Data System, the prevalence of ESRD

nearly doubled between 2001 and 2021.

Diabetes is a major contributor to the increasing ESRD rates, accounting for more than 60% of new cases in 2021.

The International Diabetes Federation forecasts a 46% rise in the global prevalence of diabetes by 2045,

highlighting the long-term demand for hemodialysis. Additionally, hypertension—which affected approximately 1.28

billion individuals worldwide in 2023—is the second most common cause of ESRD, particularly in lower-income

countries.

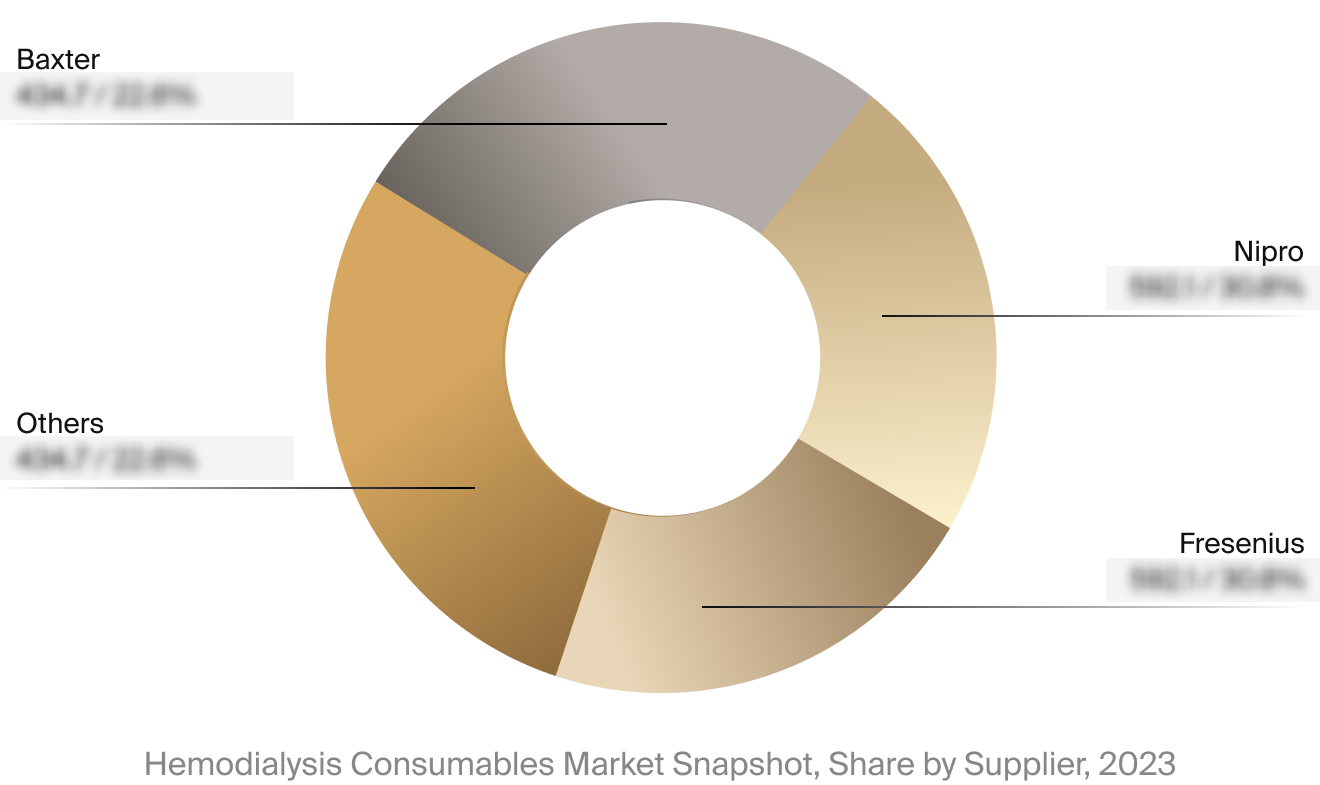

The market’s competitive landscape features leading suppliers such as Baxter and Fresenius, who provide a range

of products, including consumables and dialysis equipment. Baxter is currently exploring strategic options

regarding its Kidney Care and Acute Therapies business, which could lead to shifts in market dynamics and

opportunities for other players to expand their footprint.

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the hemodialysis

consumables market. This includes estimated market revenue and market share for key players like Nipro, Baxter,

and Fresenius Medical Care.

Select Market Events

| Company | Date | Event Type | Event |

|

Baxter

|

5/2024 | Clinical Study | Baxter announced the results of a cohort study that showed Baxter’s HDx therapy is associated with an approximately 25% lower mortality rate compared to high-flux hemodialysis for up to 4 years. |

|

Fresenius Medical Care

|

1/2024 | Product Recall | Fresenius recalled over 2 million Stay-SafeⓇ Catheter Extension Sets and Stay-Safe/Luer Lock Adapters in a Class I recall due to toxic NDL-PCBA leakage. No injuries or deaths have been reported. |

Key Companies Covered

Asahi Kasei

B. Braun

Baxter

Bellco

Fresenius Medical Care

Humacyte

Intermedt

Inspira Health

Nikkiso Medical

NxStage

Rockwell Medical

Teleflex

Terumo

Toray Medical

TVA Medical

Nipro