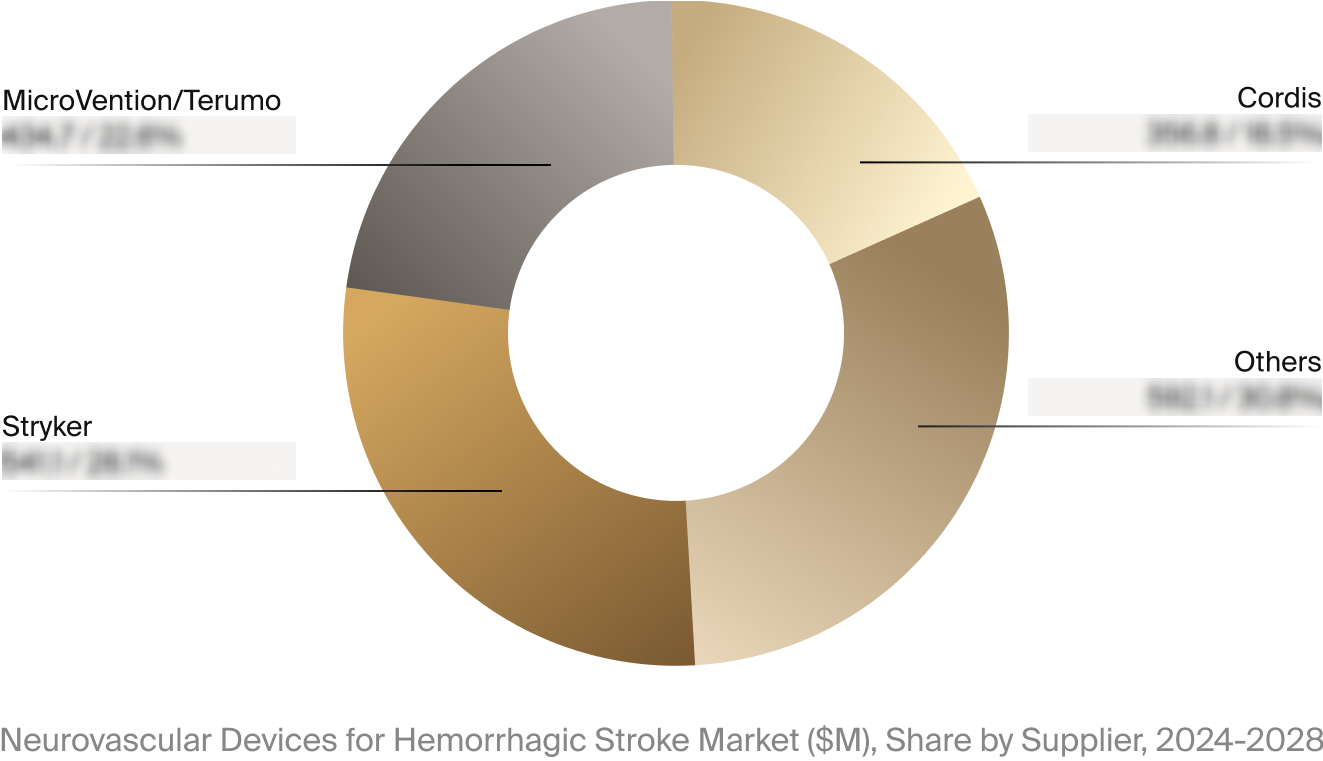

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.9 billion |

| CAGR | 6.1% |

| Projected Market Size in 2028 | $2.6 billion |

| Company | Date | Type | Event |

|

Johnson & Johnson

|

3/2024 | Product Launch | CERENOVUS announced the launch of its TRUFILL n-BCA Liquid Embolic System Procedural Set for hemorrhagic stroke. |

|

Stryker

|

9/2024 | Acquisition | Stryker completes the acquisition of NICO Corporation. |

Trusted By The Companies Pioneering What’s Next

Market Intelligence

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2024 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy