Overview

Valued at ~$779 million in 2023, the oncology embolization agents market is projected to reach

~$1.2 billion by 2028, increasing at a CAGR of 8.6% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Embolization is a therapeutic modality that induces targeted occlusion of blood vessels to destroy tumors and

lesions, such as uterine fibroids, arteriovenous malformations (AVMs), and carcinomas. This technique utilizes

embolization agents delivered through a catheter during image-guided procedures. Some agents, such as Sirtex’s

SIR-SpheresⓇ, use radioactive materials, providing a dual therapeutic effect by exposing the tumor to localized

radiation while simultaneously cutting off its blood supply.

Products included within the scope of this analysis include:

Embolic microspheres

Transcatheter arterial chemoembolization agents

Liquid embolic agents

This Market Snapshot is intended to provide a high-level overview of the global market for oncology embolization

agents, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Oncology Embolization Agents Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $779 million |

| CAGR | 8.6% |

| Projected Market Size in 2028 | $1.2 billion |

Oncology Embolization Agents Market Insights

The oncology embolization agents market is poised for significant growth, driven by an increasing incidence of

various cancer types treated with embolization devices, including radioembolization, chemoembolization, and

particle embolization devices. The scope of this analysis also includes embolization devices used for uterine

fibroid embolization as well as for embolization of peripheral vascular malformations and internal hemorrhage.

Liver cancer remains the predominant indication for embolization, with its global incidence expected to rise at

an annual rate of 2.4% from 2022 to 2030. This uptick in liver cancer cases is anticipated to bolster demand for

embolization procedures.

A notable trend within the global market is the substantial increase in the adoption of radioembolization

therapy, particularly with the use of SIR-Sphere particles for liver cancer treatment. The number of

radioembolization procedures has surged approximately fourfold between 2012 and 2023, reflecting a growing

acceptance of this therapeutic approach.

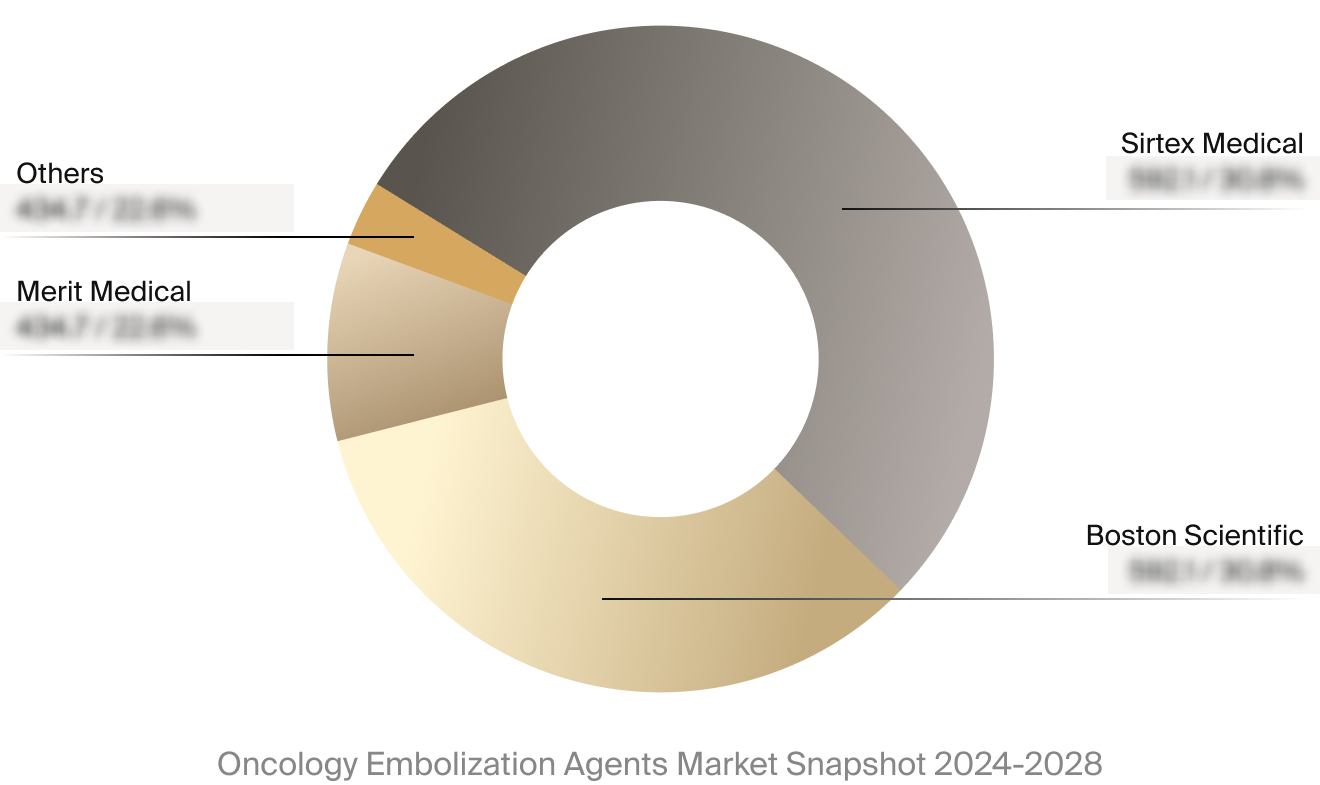

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the oncology embolization

agents market. This includes estimated market revenue and market share for key players, such as Boston

Scientific, Sirtex Medical, and Merit Medical.

Select Market Events

| Company | Date | Event Type | Event |

|

Sirtex

|

3/2024 | New Hire | Sirtex Medical appointed Matt Schmidt as CEO and Board of Directors member. |

|

Merit Medical

|

10/2024 | Regulatory | Merit Medical announced the launch of its Siege™ Vascular Plug, which received U.S. 510(k) clearance earlier this year. |

Key Companies Covered

Arsenal Medical

Boston Scientific

Cook Medical

Cordis

Instylla

Medtronic

Merit Medical

Sirtex Medical

Stryker

Terumo

Varian