Overview

Valued at ~$1.6 billion in 2023, the percutaneous transluminal angioplasty (PTA) balloons and

vena cava filters market is projected to reach ~$1.9 billion by 2028, increasing at a

CAGR of 3.7% over the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

The PTA balloons and vena cava filters market encompasses several endovascular solutions for treating peripheral

artery disease (PAD), also called peripheral vascular disease (PVD). PTA balloons restore blood flow to vessels

occluded due to plaque buildup (atherosclerosis). They are often utilized in conjunction with revascularization

techniques (e.g., atherectomy, intravascular lithotripsy) to restore blood flow in peripheral blood

vessels. Inferior vena cava filters, or IVC filters, are temporary or permanent devices that prevent thrombotic

material from traveling to the lungs.

Products included within the scope of this analysis include:

Peripheral angioplasty balloons

IVC filters

This Market Snapshot is intended to provide a high-level overview of the global market for PTA balloons and vena

cava filters, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

PTA Balloons and Vena Cava Filters Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $1.6 billion |

| CAGR | 3.7% |

| Projected Market Size in 2028 | $1.9 billion |

PTA Balloons and Vena Cava Filters Market Insights

The PTA balloons and vena cava filters market is primarily driven by the shift towards minimally invasive

solutions and advancements in the detection of PAD. As detection methods improve, the prevalence of PAD is

increasing, with some studies suggesting that PAD is rising at a faster rate than coronary

artery disease. Many times, by the time PAD is detected, medications and lifestyle changes alone are

insufficient in managing blockages, necessitating an intervention.

Significant market events, such as clinical milestones, further shape market dynamics. For example, in November

of 2023, BD presented positive long-term results for its Lutonix™ drug-coated balloon (DCB), reinforcing the

safety of the device and positioning balloon angioplasty as the preferred endovascular intervention.

Fueled by demographic trends—particularly the rising population aged 65 and older—the PTA balloons market

continues to grow steadily. In contrast, the vena cava filters market is declining, with procedures dropping by

36% in the U.S. Medicare population from 2017 to 2022 due to ongoing safety concerns and recommendations for

limiting the use of filters by national organizations.

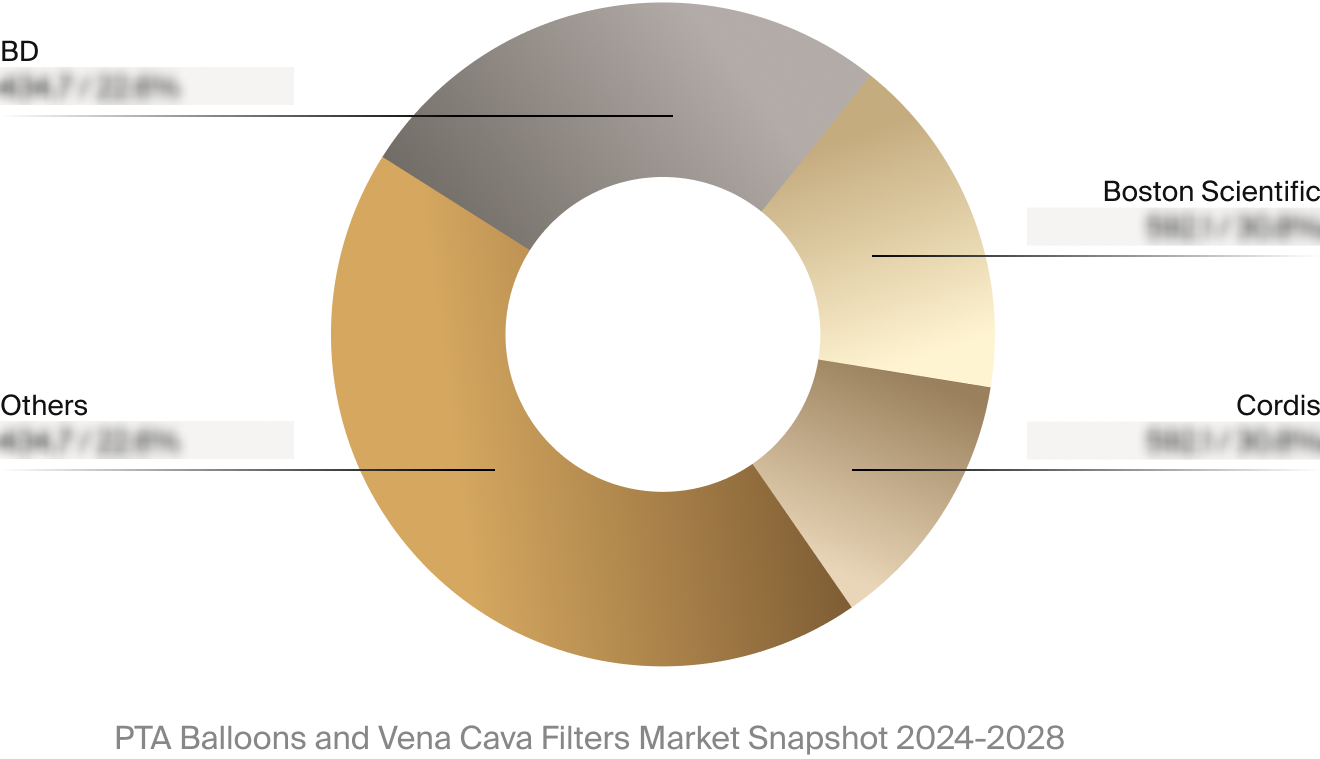

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the PTA balloons and vena

cava filters market. This includes estimated market revenue and market share for key players, such as Boston

Scientific, BD, and Cordis.

Select Market Events

| Company | Date | Event Type | Event |

|

Cordis

|

10/2023 | M&A | Cordis acquired drug-eluting balloon maker MedAlliance for $1.1 billion. |

|

BD

|

11/2023 | Clinical | BD presented results from the SAFE-DCB Registry, showing the company’s Lutonix DCB was safe and effective and provided durable long-term outcomes in over 1,000 patients. |

Key Companies Covered

Abbott

B. Braun

BD

Biotronik

Boston Scientific

Brosmed

Comed

Cook Medical

Cordis

Degania Medical

Medtronic

Merit Medical

Nipro

OrbusNeich

Phillips

Summa Therapeutics

Terumo

TriReme Medical