Overview

Valued at ~$47.6 million in 2023, the renal denervation devices market is projected to reach

~$128.7 million by 2028, increasing at a CAGR of 22% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Renal denervation, or RDN, is a minimally invasive surgical technique used to treat refractory hypertension by

utilizing energy ablation to alter the renal nerves. The procedure involves percutaneously interesting a

steerable ablation catheter to the renal artery through a femoral sheath and a guide catheter, treating each

renal artery in succession.

Products included within the scope of this analysis include:

Renal denervation catheters

This Market Snapshot is intended to provide a high-level overview of the global market for renal denervation

devices, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Renal Denervation Devices Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $47.6 billion |

| CAGR | 22% |

| Projected Market Size in 2028 | $128.7 billion |

Renal Denervation Devices Market Insights

The renal denervation devices market has experienced a complex trajectory over the past decade. Despite being

commercially available in Europe for over a decade, renal denervation technologies have struggled to gain

traction after a significant setback in 2014, when Medtronic’s SYMPLICITY HTN-3 pivotal trial failed to meet its

primary efficacy endpoint. This led to a decline in market activity, with the number of procedures in Europe

peaking at 16,900 in 2014 before diminishing. However, recent positive results from trials such as SPYRAL and

RADIANCE have reignited interest—particularly with the introduction of Recor’s Paradise™ Ultrasound RDN system,

which received approval in November 2023, alongside Medtronic’s Symplicity Spyral™ RDN system.

Globally, hypertension affects over 1.3 billion people and contributes to more than 10 million deaths annually,

creating a substantial market opportunity for innovative treatments like renal denervation. The traditional

pharmaceutical approach to managing hypertension faces challenges such as patient compliance issues,

highlighting the potential impact of a durable procedural solution.

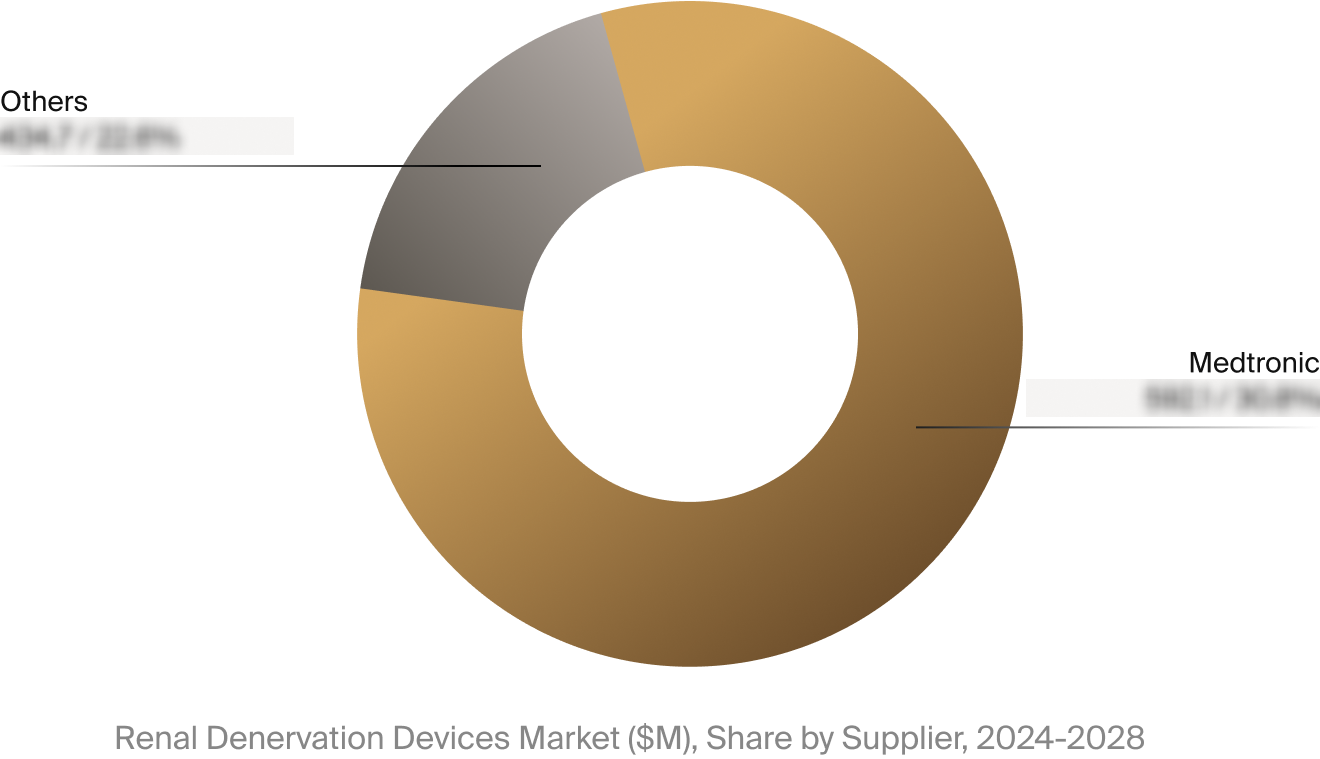

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the renal denervation

devices market. This includes estimated market revenue and market share for key players like Medtronic.

Select Market Events

| Company | Date | Event Type | Event |

|

Medtronic

|

11/2023 | Regulatory | Medtronic’s Symplicity Spyral RDN system received FDA approval. |

|

Recor Medical

|

11/2023 | Regulatory | Recor’s Paradise Ultrasound RDN system received FDA approval. |

|

Medtronic

|

5/2024 | Regulatory | Medtronic’s Symplicity Spyral RDN system received approval from the National Medica Product Administration (NMPA) in China. |

Key Companies Covered

Abbott

Boston Scientific

Covidien

DeepQure

Medtronic

Metavention

Otsuka Medical

Recor Medical

SoniVie

Terumo