Overview

Valued at ~$100 million in 2023, the rotator cuff repair suture anchors market is projected to

reach ~$104 million by 2028, increasing at a CAGR of 0.8% over the 2023-2028

forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Torn rotator cuff tissue can occur due to injury or degeneration, with gradual wear and tear due to aging being

the most common cause. A rotator cuff repair is a minimally invasive procedure that involves repairing a torn

rotator cuff using sutures and small screws, known as suture

anchors, which serve as an essential tool in sports medicine.

Products included within the scope of this analysis include:

Suture anchors for rotator cuff repair

This Market Snapshot is intended to provide a high-level overview of the global market for rotator cuff repair

suture anchors, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Rotator Cuff Repair Suture Anchors Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $100 million |

| CAGR | 0.8% |

| Projected Market Size in 2028 | $104 million |

Rotator Cuff Repair Suture Anchors Market Insights

The rotator cuff repair suture anchors market is experiencing steady growth, driven by the increasing volume of

rotator cuff repair procedures, particularly in Asian markets such as Japan, China, and South Korea. This growth

is closely tied to the aging global population, as rotator cuff tears are more prevalent in older individuals.

The rate of repair procedures is rising in line with the expanding 65+ population, which is growing at an annual

rate of 2.9%.

However, the market’s growth faces some challenges—largely due to results from recent outcomes studies showing

less-than-expected patient benefit from rotator cuff repair. This has led to some caution around procedure

adoption. Despite these challenges, the continued prevalence of rotator cuff injuries and the aging population

are expected to keep the demand for repair procedures and suture anchors on a modest upward trajectory.

Price pressures and increased competition from lower-cost suppliers, such as those in China, continue to affect

the market. While this has contributed to some price erosion, the overall dollar volume of the market is

projected to remain relatively stable over the forecast period.

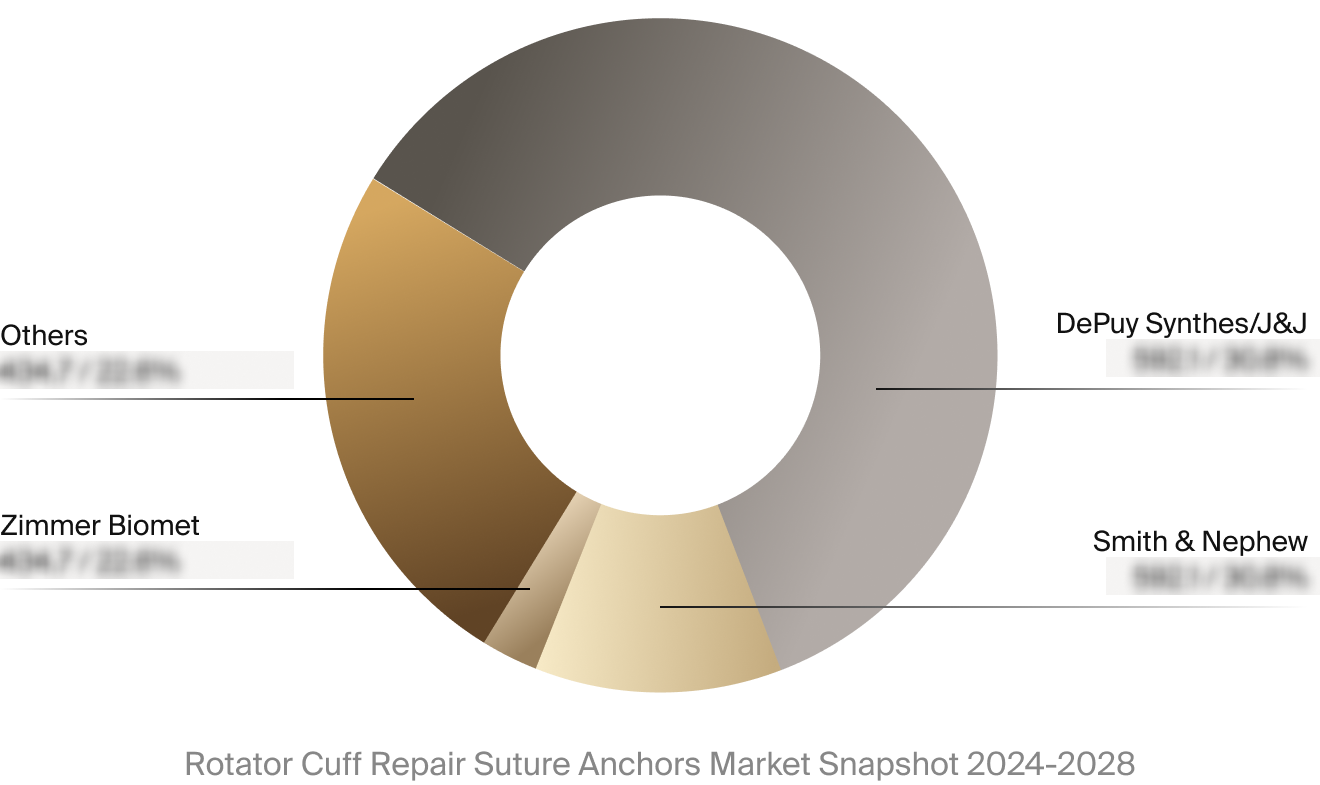

DePuy Synthes, the orthopedic company of Johnson & Johnson, remains the dominant supplier of rotator cuff repair

suture anchors, maintaining its market leadership—primarily due to Johnson & Johnson’s strong presence in the

broader orthopedic

and sports medicine device markets. As the market continues to evolve, competition will increase, and players

who can offer cost-effective solutions without compromising on quality will be well-positioned for future

growth.

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the rotator cuff repair

suture anchors market. This includes estimated market revenue and market share for key players, such as DePuy

Synthes, Smith+Nephew, and Zimmer Biomet.

Select Market Events

| Company | Date | Event Type | Event |

|

Arthrex

|

8/2023 | Lawsuit | A class action lawsuit was filed against Arthrex in the United States, alleging that a design or manufacturing defect in the company’s suture anchors caused the anchors to break during implantation. |

|

Integrity Orthopaedics

|

12/2023 | Fundraising | Integrity Orthopaedics closed a Series B funding round of $20.6 million to expand the U.S. commercial launch of its lead product for the rotator cuff repair market. |

Key Companies Covered

Anika Therapeutics

Arthrex

CONMED

DePuy Synthes

Inovedis

Integrity Orthopaedics

Johnson & Johnson

Smith+Nephew

Stryker

Tetrous

Wright Medical

Zimmer Biomet