Overview

Valued at ~$374 million in 2023, the upper and lower extremity suture anchors market is

projected to reach ~$490 million by 2028, increasing at a CAGR of 5.6% over

the 2023-2028 forecast period. This Market Snapshot is part of LSI’s Market Intelligence platform, your

one-stop-shop for global medtech market sizing and analysis, procedure volume data, startup company- and

deal-tracking, curated insights, and more.

Severe soft tissue tears are treated through surgical intervention when standard rest, compression, and

medication are insufficient to repair the injured tissue. These procedures utilize suture anchors to securely

attach soft tissue to bone. Suture anchors are widely used in orthopedic surgeries, including cartilage,

ligament, and meniscus repairs in the upper and lower extremities. The market for suture anchor devices includes

bioabsorbable, biocomposite, metallic, and PEEK suture anchors.

Products included within the scope of this analysis include:

Suture anchors for repairing upper and lower extremity soft tissue defects

This Market Snapshot is intended to provide a high-level overview of the global market for upper and lower

extremity suture anchors, with key insights into:

Unit volumes from 2023 to 2028

Market forecasts from 2023 to 2028

Market insights

Competitive landscape analysis of major competitors

Insights into key market events for strategic and startups

Upper and Lower Extremity Suture Anchors Market Snapshot Summary

| Snapshot Aspect | Data and Details |

| Base Year for Estimate | 2023 |

| Forecast Period | 2023 - 2028 |

| Market Size in 2023 | $374 million |

| CAGR | 5.6% |

| Projected Market Size in 2028 | $490 million |

Upper and Lower Extremity Suture Anchors Market Insights

The upper and lower extremity suture anchors market is poised for strong growth, driven by increasing procedure

volumes. Notably, unit volume for upper and lower extremity repair devices is projected to grow at a higher rate

than shoulder repair procedures globally, based on the most recent procedure volume estimates. While pricing

pressures persist, similar to the rotator

cuff suture anchors market, slight increases in average selling prices are anticipated due to rising

inflation.

Market value growth is forecast to accelerate, with an expected increase of 5.6% over the forecast period,

compared to 4.1% in the previous year’s analysis. This growth is largely fueled by rising procedure volumes,

driven by shifts in procedures to Ambulatory Surgical Centers (ASCs) and increased demand for extremity repairs,

particularly among younger adults. As these treatments become more accessible, the market is expanding.

Despite pricing pressures, the demand for cost-efficient, high-performance suture anchors continues to drive

innovation. Companies that focus on product quality and procedural cost reduction will be well-positioned to

capture the growing demand for extremity repair solutions.

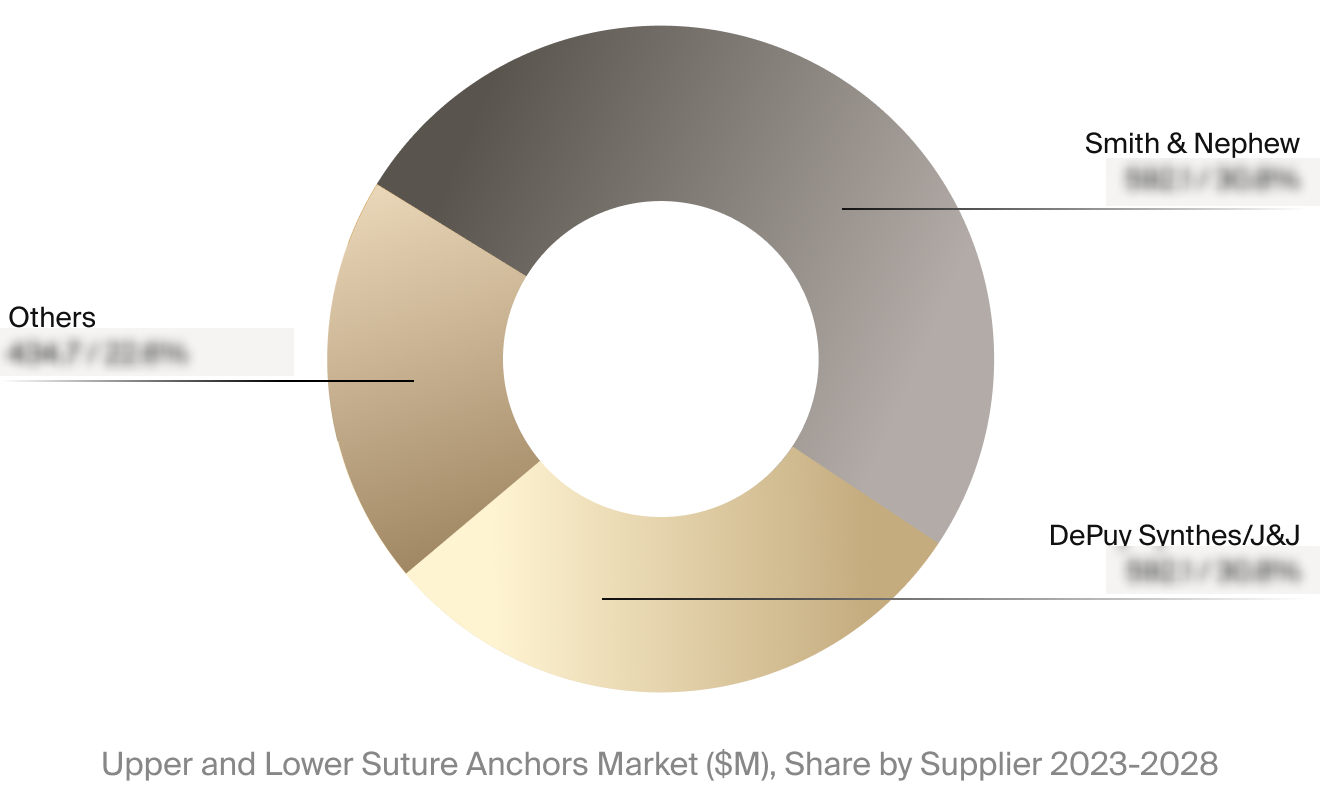

Competitive Landscape

The full Market Snapshot includes a robust analysis of the competitive landscape for the upper and lower

extremity suture anchors market. This includes estimated market revenue and market share for key players, such

as Smith & Nephew and DePuy Synthes/Johnson & Johnson.

Select Market Events

| Company | Date | Event Type | Event |

|

Paragon 28

|

1/2024 | Commercial | Paragon 28 launched the GrapplerⓇ Knotless Anchor System and Bridgeline™ Tape for use in the foot and ankle soft tissue market. |

Key Companies Covered

Arthrex

CONMED

DePuy Synthes/Johnson & Johnson

Fuse Medical

Paragon 28

Smith+Nephew

Zimmer Biomet