Transcription

Henry Peck 0:08

Our next panel here is med tech the next generation founders and CEOs. This panel is moderated by Dave Uffer, who's the vice president of medtech at General Inception. General Inception is a precede med tech accelerator and venture studio. And we're super excited to have Dave do this panel as well as the rest of the panelists. Dave spent 30 years leading m&a and other corporate development functions at the largest global med tech strategics. And through that experience, he's here to share that with us in the prospect of bringing emerging first time younger new CEOs to the front of our community. So thank you so much, Dave, for doing this panel and overdue.

David Uffer 0:46

Thank you, Henry. And I want to thank LSI and Scott Pantel for just a tremendous conference here really appreciate the opportunity to host each of the panelists. I think, each and every one I've known either since inception, or very early in their journey. And as Henry was mentioning, while I was in business development and corporate development for 25 years, prior to being in venture had the good fortune to screen, about 15,000 companies led by many different prototypes and prototypes of technologies and many different types of CEOs. We want to highlight here is a little bit different ecosystem that I'm seeing in the CEOs that are leading some of the more exciting companies. Most are either first time founders or young in their personal careers, but not for any lack of drive. What I find is just a very exciting crew. I want to start this with giving an introduction to each of them. So I don't want to introduce you please. Name rank and serial number, and then we'll get into some of the content.

Kevin Rocco 1:53

A good afternoon, everybody. My name is Kevin Rocco. I'm the former CEO founder of a company called Biorez. We were acquired by Conmed Corporation in August, and I'm here on behalf of them. Thanks for having me.

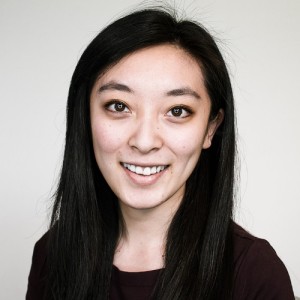

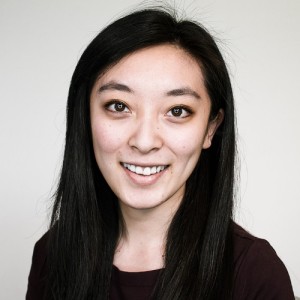

Rui Jing Jiang 2:08

Hi, everyone. My name is Rui Zhang Jiang. I'm a founder and CEO at Avisi Technologies. I'm a first time founder and our company is making a nanotechnology enabled implant to treat glaucoma. It's a huge honor to be here. Thank you.

Yuval Mandelbaum 2:22

Good afternoon, everyone. My name is Vaughn Mandelbaum. I'm the CEO of dis cure. And in this cure, we developed quite a unique, smart implantable device to treat and reverse degenerative degenerative disc disease, which is truly one of the larger unmet needs out there today. And we're excited about this. We're going going some interesting places.

Jayon Wang 2:43

Hey, everyone, my name is J. Yan Wang, I'm the CEO at X-Cor Therapeutics. X-Cor is an extra pauriol co2 removal system for treating hypercapnic respiratory failure. I'm a second time founder and I have the unique pleasure of working with Dave at General Inception trying to reimagine how companies get off the ground or co founded and funded through early stage.

David Narrow 3:05

Hey, everyone, it's an honor to be in the presence of such exceptional co founders and CEOs. My name is David narrow co founder and CEO of Sonavex, we're hopping spin out in the dialysis space.

David Uffer 3:16

Great. Well, thanks for the introduction, everybody. I want to start this panel with a little bit of a story from Kevin got to know Kevin many years ago when he had taken a technology that had a little bit of a failure reformulated restarted the company and in his 20s, I might add in had an exit this past summer and north of $200 million. And this was in less than seven years. Very exciting in medtech. I wanted to walk through some of the challenges that you faced in the successes and how you actually restarted to this company and let it through to an exit so early.

Kevin Rocco 3:58

Open ended question just like that, tell the story. Okay. So hey, everybody. So I was the founder CEO of a company called Biorez where we were really committed to improving tendon and ligament healing. You can think of ACL reconstruction, rotator cuff repair. If you've had your ACL torn repaired, it's, it's really a slow, painful process to get back to full activity. rotator cuff tears can fail 30% of the time, retear 30% of the time, so lots of room for improvement on the clinical side. As Dave mentioned, I was actually the second full time employee of a predecessor company called Soft Tissue Regeneration raised $13 million. I had a suboptimal technology and it actually failed. So I was 29. So I guess I was in my 20s. But I did work with the existing investor group. At the time to restart I was convinced that there was a massive unmet clinical need and I think that's what's exciting about being here at a conference like this. It's bringing together really entrepreneurs and operators and investors to try to go after these on MIT needs, there's no doubt that there's a lot of room for improvement across medicine and sports medicine was just one of those places. So kind of fast forward. As Dave mentioned, we set out to make a, an improved mousetrap a version 2.0 of the predecessor of technology. And then along the way, we learned so much more. I think that's maybe one of the lessons we really had a first mover advantage on implants that could add strength to repair but also helped improve the healing process. And based on that knowledge, and based on that investment, we actually ended up pivoting to a different technology company owned IP. So we talk about challenges. I mean, one of the challenges for me, of course, was I was 29 years old, first time CEO, solo founder, no university spin out, no prior exits, no, sort of No, nothing really. And investors don't always like that story. So year in and year out, I would come to conferences like this, meet awesome CEOs meet great investors. But it was a challenge. We ended up raising $12 million, kind of by hook and by crook, just getting it done. We never ended up with really big name brand VCs, we never had 20 $30 million. Some of the folks on this panel are far better at that than I am. So really what we did was we kept the north star as the unmet clinical need. We raised as much money as we needed to get it done. And in the end, really, in the end. The irony is that, while not I couldn't convince all investors of our value proposition. It was very clear to surgeons, it was very clear to patients. And ultimately it was clear to strategics. And I don't know if Dr. Schneider is in the room here, but actually bumped into Steve Schneider out in the hallway. He's a legendary orthopedic surgeon, he ran the Southern California orthopaedic Institute for many years. And he came up to me and said that Conmed buying Biorez was the greatest thing Conrad's done in many years. And so that just made my absolute day, I had to share that because, you know, rewind the tape four years ago, three years ago, two years ago, I couldn't convince investors of that. So in the end, I guess maybe that's one of the takeaways here is like, you got to stay alive, you got to keep going, raise the money, however it takes. And if you solve that problem, you know, for the patient or for the surgeon or for the payer, or for the hospital, or hopefully all of them, there's there's a huge amount of value to be created. And ultimately, that's that's what happened with Conmed, they saw it convents, about a billion dollar revenue company, so they're not able to compete with j&j, or Stryker, or Arthrex, some of the larger incumbents, and they, they knew that they they had to make a move early. And to their credit they did, they, they got us kind of before them, they made a move early. And so far, it's gone great for them. And I'm happy to report you know, today, the the Biobrace was our implant, it's been used over 1000 times in the last 18 months, we have almost 200 surgeons using the implant regularly. And all signs are good clinically. So it's, I think, a smart acquisition by Conmed.

David Uffer 7:56

So this isn't a comment about previous management. But with the restart a recap, what were the critical, critical success factors that you brought in, in a new management team and new to leadership in the style, which led to the success of this program.

Kevin Rocco 8:13

So it's interesting, I live, I live both worlds. And then obviously, I want to open up to the panel here. But I live in both worlds where I worked for a CEO that did have a co founder that was a prestigious surgeon at a prominent university, kind of the tried and true recipe of startup. And I think one of the differences is I'm an engineer by training. So peer reviewed publications in this type of technology. So backing, you know, if I could lobby, maybe the group and I know some of the folks up here are technical as well, you know, backing younger, technical entrepreneurs, I think is key because we would have probably never made that pivot. If if I were just a business person. And note, no disrespect to kind of just business people. But when you're kind of creating new technology, you need to have core competency in that technology. I think that's that was it for me.

David Uffer 9:02

I think what we'll hear is many diverse backgrounds and different success factors really depends on the company and what the objective is. David, let's go to you next. Very unfortunate, large market and ESRD, we will wish we could do to help alleviate some of the suffering in this condition, large growing population, it's pretty crowded area. You've been in an area that's been in your technology with many failures as well as many successes and exits. You're creating a novel new approach to gaining access for these patients. Talk about your experience and where you've had difficulty getting in front of either investors strategics and building out the organization in this particular space.

David Narrow 9:51

Sure. So yeah, the dialysis market is obviously large growing, there's a number of ways to attack it. No single company is going to solve all the problems. I think that has been net positive for us. When we started our company, there were four indications that we were looking at. And where we felt that there was a clear strategy. It was a smaller market, but where we found that there was more interest among all stakeholders in this more complex dialysis space. And I think one of the things that's been helpful for us and this, if you were to ask the question that we were talking about on the panel about, you know, what, what do you do to as a younger CEO, to out compete and to get that capital, it's, you've got to show that maybe you haven't done this three or four times. But you understand the market, you understand the policy, you understand the other players where they stand, how you stand, and you can skate to where the pucks going to be. So I give a lot of credit to my former employer, as a consultant, we had to do this stuff for other people. And I was sort of trained to digest these markets understand what's going on and put together a strategy and in our data room, have PDFs of written up materials, digesting primary and secondary research so that you can convince someone that maybe he knows or maybe doesn't know about this base, that you've got a good grip, and you really understand what you're doing. So I think that's, you know, the concluding statement that I was thinking, the first thing that I saw when we were talking about this panel is, it might be easier to get further down into a fundraising funnel, if you've done this three or four times and you start with an advantage. So you start higher up in that sales funnel, and you just got to get through it. And how do you do that you out, compete and use what you can to your advantage, whether it's surrounding yourself with other people who've been there, done that, by really spending the extra time and effort work ethic to show people you understand this, you're not going to win every time, but you can convert some of those nose into yeses, by being a little more aggressive on the front end.

David Uffer 11:35

Interesting perspective, gentlemen, before Kevin gets mad me for not going back to biomedical engineering founders and background, you actually have both sides of it in that background, in engineering, from Carnegie in the business side from Harvard, as well as your on your second company, under 40, companies founded and started a little bit about your journey and the experience of getting the second one off the ground when you already had done that once before.

Jayon Wang 12:09

Yeah, I think that it's probably a shared experience for all of us on the panel that as a early career leader or a founder, you know, you have it's given that you have to try and overwork and use every ounce of grit, you have to try and avoid all of the major mistakes and bullets that can probably end an effort. But I would say that, again, it's probably a shared experience for all of us that when companies and products do end up finding that product market fit when they do end up successful when they do get funded and see commercial success. You know, while we can be the glue that holds a lot of that team together, I'm sure all of us have a village of of senior scientists, clinicians that we've worked with, as well as junior engineers, quality folks, you know, across the board, and as well as out of house service providers that are willing to work with us to provide the the kind of village labor effort that makes these things successful. By no means is it ever like a one person show. And I think what I really learned the most out of my first company, second company, being exposed to so many other founders, teams operating in engineering worlds or business worlds, maybe even unrelated to medical devices is that ability to work together stay together over the five year 10 year period it takes to make any of these things real is kind of the differentiating factor, I think that really leads a lot of companies to success versus tripping up on those earlier milestones.

David Uffer 13:45

You've all it's moved to you next time, you come from a unique experience being part of an incubator in Israel and actually took one of the companies to say I'm going to take the helm in the reins and lead this little bit about the challenges that you've faced A being first time CEO, and B, you're doing this from afar outside of where the greater amount of capital is, is typically circulating in the US. And certainly there's a really nice access between Israel in Europe, we've seen a lot of money in the past that was coming from China, but you've got to be on the global circuit. There's not a lack of innovation in Israel, but there's certainly a lack of capital of support the medtech industry.

Yuval Mandelbaum 14:28

Now that's 100% Correct. Like I think as an Israeli CEO kind of living in a island country, where you can innovate in Israel, but you can't a fund and you can commercialize. So you have to kind of look outward. And beyond that circuit, I was just remarking today that kind of feel like on the tennis racket with tennis circuit with my Israeli friends who are in the conference, because you keep seeing the same people in same faces if it's in Dublin, or if it's in California or Boston, and the same faces kind of keep popping up. And with respect to coming out of an incubator and kind of taking the helm, on a new innovation and a new spin out company that has been developed. I think it's true for me, it's true for pretty much every new CEO, or first time CEO, you have a chip on your shoulder, and you have to prove, kind of prove your worth. And you have to do that, as my friends here said, you have to do that through execution. There's really no other way. Because you can't you can't show any past accolades as a reason why you should fund this, you have to show validation, you have to show milestones, and you have to really execute on what you promise and deliver. And I think the other side of that beyond the execution side, is really that first time CEOs, I think, come with a certain humility, that you don't always like I would expect you wouldn't always have with successful or if previously successful CEOs. And the advantage that comes with that is really the ability to surround yourself, as I think everyone here has said, there's really no other way to execute, and to surround yourself with mentors, with employees that are perhaps smarter than you or experienced than you. And that can really help you in this journey. And it really takes a village. I think that's it's a cliche, but it's, it's true. And like, in my personal experience, we've been I've been surrounding myself with every smart, experienced person that I can, and kind of try to put my ego aside here. And I think that's easier when you don't have all that track record behind you. And you can really leverage a lot of that experience and shared experience from board members, mentors, employees, for example, I'm probably 10 years younger than the second youngest employee in my company. And we have people with 30 years of experience and clinical development, 20 years of experience in r&d development. And I think that's paramount in order to succeed as a first time CEO.

David Uffer 16:50

I want to expand on that, but in just a moment, because I have to get to Rui This is one of the warmest stories I have in that if anybody hasn't met Ben Glenn here, you shouldn't running meta innovation, doing amazing press and called me one day said, Dave, you have to come up to MIT, we've got an amazing crew of companies that's going to present and really need some mentorship, I went there and met Rui. I don't want to be rude, but I have to say greener than the Hulk, in experience, came out of UPenn found a technology there and built an application and market greener than the Hulk but not smaller or more aggressive. I'm talking somebody that was demonstrating amazing leadership and taking a technology that she found at the university. And I'll say in the past five, six years is won more awards than I could count in leading this company. Talk about this experience, going from undergraduate in UPenn, and finding a technology and saying I'm going to find a clinical application and market for this.

Rui Jing Jiang 17:55

Thank you for the kind words, Dave, I mean, we wouldn't be here if it weren't for mentors like yourself, who are so generous with your time and your experience to help us see around corners. So our story out of UP as a little bit unique, we really focused on the clinical need. In the very beginning, there was a very novel technology invented at the University of Pennsylvania that was marketed as a thin film as thin as a soap bubble, but ultra light and robust, and people weren't really thinking about using it in healthcare applications. For our team, you know, we're really motivated to think about issues and vision because the eye is a very small organ, and yet it's responsible for how we interact with our world. When we started speaking with ophthalmologist, they were the ones who pointed to glaucoma as one of the biggest emerging needs that a small, thin, robust technology could really help impact and improve. When we went and met you at MIT, I think we were a group of 20 year olds, obviously had never run a company before. And I think it's that intellectual humility that you've always talking about here. That enabled us to ask for help, not just from you, but also from ophthalmologists. We spent countless hours shadowing at conferences like this and that American Academy of Ophthalmology, shadowing and the OR are asking very basic questions like, Why do you use this implant in this way? Why do you hold this tool to do this maneuver? And what does that mean for the patient? We shadowed and follow up visits where we heard patients talk about their frustrations with medications that made their head spin or their eyes hurt, or just impacted their daily quality of life. And I think taking all of those lessons, being open to the advice that was coming towards us, and being unafraid to fail has really helped us get to where we are today. So the company has raised over seven and a half million dollars. We have completed enrollment and our first in human clinical trial. We've treated over 22 patients around the world, and it's looking really good. So I think If not for, again, mentors like you and the ophthalmologists on our team, we definitely wouldn't be here.

David Uffer 20:06

So I guess coming back to Kevin's original point, just don't think of the business what I'm hearing a common theme is you're always starting with the patient in mind and what's going to benefit the patient, and the clinician who's going to deliver this technology in use the technology, whether it's a better patient outcome, it's faster, it's easier to use, it helps them whatever that be, but the two constituents of the patient and the clinician, and then you'll work on the entire business plan, which of course, you don't have a company without a business plan. But that's your starting point. Talk about the not afraid to fail, David, again, we talked about some roadkill in your space, but you're charging hard in a very important area, what have been some of the errors that you've learned from either other failures or that you're keeping your sightline to say, here's what we need to do to not end up where they did and what we're doing differently?

David Narrow 20:54

Yeah, I think the important part is you don't just stop at the patient and the clinician, right? Those days are over, you got to figure it out. Everybody that has a direct and indirect impact on stake a stakeholder right. And some of these markets are more complicated than others. Obviously, dialysis is probably on one end of the spectrum. And maybe some of these others are simpler. But, you know, for us, we're looking at first and foremost, the patient. You're looking at the physician here, there are multiple physicians, you've got an astrologist, you've got a surgeon, you've got the dialysis organization, you've got the hospital, you've got the payer, and making sure that everything that you're thinking through, you're going around and ensuring that the strategy is satisfactory for each of those stakeholders. And I think in the dialysis space, in particular, that's where most of these companies that failed, there might be something that's 10, or 20, or 30%, better for the patient. But if it's not compatible with all the other stakeholders that enable that technology to get to the patient doesn't matter. So that's a word of wisdom or something that we've spent a lot of time focused on. Because if you don't satisfy those other checkboxes, that technology never makes it to the patient.

David Uffer 21:58

You've all you'd mentioned, look, you're not you have to be a jack of all trades, maybe you're not the expert in every discipline, knowing when the buck stops with you at the end of the day as the CEO, but you have to be able to read through somebody telling you whether they're your head of clean ups or regulatory, here's my direction, and you have to make those decisions. Is it really surround yourself with people that you have to either trust or test and make those decisions or you trust them? Implicitly, you've hired them you put them in place? How do you decide when they probably have a lot stronger background in those particular disciplines than you.

Yuval Mandelbaum 22:36

You know, I'm referring said about being without ego at this early stage, I can't say that's entirely true. Sometimes you do bring your ego to the table and like, so you do want to trust you bring on people who you trust to, I couldn't take their place like like my Chief Clinical Officer, like she's run over 15 First in human studies, and like five pivotal roles. So I'm not going to tell her how to do her job. That being said, I do want to hear everything she has to say. But at the end of the day, you want to make sure that everything checks out, and that you're certain that's the right way to go. So you do also want to validate that not just with your own common sense, but as well as the mentors that you surround yourself with on your board. And, you know, I think we're not a large group. And we do try to do things kind of holistically, and not just hierarchically and we work as a team, we work as a matrix, we make important decisions. As a group, I do have the final word on that, me or my board or with my board. But we do try to make these large decisions as a group bringing in everyone's experience. Like it's not one person's decision if it's, if we're doing, I don't know, a certain endpoint or another for clinical study, or if we're selecting one manufacturer or different one. Like we're bringing on really top notch people to help us with that. So Beyonds, we're a small team of four people full time two people part time, but we augment that team with really top notch advisors in key areas. So if that's groups that help us with approaching FDA or selecting the right manufacturer, and development partner, so that those are not the decisions that can always make by yourself, or just with your team, you want to kind of branch that out and got a larger spectrum of opinions and perspectives from people have really had a lot of experience. And that's what we generally try to do.

David Uffer 24:35

Great got to change up just a bit of direction. I made an acquisition that logic of a company that was led by somebody with 20 plus years experience leading a multi billion dollar company in one of their business units. A week after I acquired it. He called us a diva, you know how hard it was for me to raise capital. Even with my background and experience it was getting inched shut out no so many times. And now everybody's calling me all the VCs are calling me say, what's your next company we want to invest, we want to invest. It's difficult to raise capital, regardless of if you've been there and done that before, if this is your first time, but even is, you know, somebody that hasn't been part of a major organization, 25 year track record, let's not be too rosy, tell me about the challenges of really getting funded and working through these issues with the VC community. That's for you.

Kevin Rocco 25:33

I mean, I can't reiterate enough, the challenge is probably the struggle for me, I don't know about the rest of the team here. I was trying to, we were never well capitalized. So I never was able to go out and hire all the experts to be kind of out of the gate together. So we were trying to build the car and drive the car at the same time and kind of being the lead on technology and development, while also being the CEO was very challenging, because I know firsthand that my slides and my story aren't that good. Like, I'm smart enough to know that at least right? So when I go up on stage, it's like, yeah, I know, this cartoons really cheesy. I know, this isn't as good as it could have been. But I also didn't have $100,000 to spend to make it all really good. So I'm sitting there and economy like a T Rex trying to work on my MacBook to get my slides to look good coming out here. And, and so. So there's an element of that, which is like, if I could have focused 100% of my time, on just doing that, I would have been probably a lot better at it. So I think for me, that was one of the challenges. And yeah, I mean, it never ended. But I was very fortunate to find, you know, just enough investors that believed in it saw it believed in me, or maybe even better, they put a little bit of money in. And then they were along for the ride for a little bit. And they got to really see firsthand what we were doing. And then the team that we started to build and the mission we were pursuing. And, you know, I love medtech entrepreneurship. I think there needs to be more of it. And I think that it is funny to come back a year later, when just a year ago, I was here trying to raise money. So a lot can change in here.

David Uffer 27:19

Right? Look, you've taken on a very difficult era, I was 20 plus years ago, of all places at Boston sigh when I was bizdev, we were doing a white space slash Skunk Works project in ophthalmology. And when we met, I was so excited, I could actually say trabecular mesh, and know a little bit of something in ophthalmology and I saw so many challenges of doing what you're doing. Not only the raising capital, but building in a very difficult market. What have been the greatest challenges that you've been facing and what's led you to push through these.

Rui Jing Jiang 27:55

So when we say a difficult market, it's very crowded, because Glaucoma is a very big problem that affects over 140 million people. There are a lot of competitors. But I think the reason why there's still opportunity and why investors are still excited is because of new material technologies. And that's what we're working on. I think when you can have a very differentiated product and speak directly to how physicians will adopt it, how it will impact their patient outcomes and how it can, you know, save money for the healthcare system. That is a very compelling value proposition. I think some of the challenges, you know, early on, as Kevin alluded to, it is hard to raise money for for everyone. And for us, we really tried to rely on non dilute of capital in the beginning. We wrote, you know, many, many grants. I think when we left the university we had $300,000 in non dilutive funding. From there, we got 250k from the National Science Foundation phase one SBIR, and then from there, we got a phase two $1 million grant from the SBIR program, and kind of staying away from dilute of capital as long as we could to get to a point where we had some proof of concept for our value proposition that helped us, you know, overcome some of those early funding challenges that I again, I think every CEO will face.

David Uffer 29:14

Jayon, moving over to you, you. You're able to lead a team without having to take on every role and really delegating you have a tremendous clinician, on board, you've got a great new technology developer, you've got a great co founder. And it doesn't seem like you have to put your finger on everything that you have a great trust with your team tells us about when to jump in and when to back off and let people lead independently and how you motivate them. Keep that kind of CEO role. They're overseeing everything but knowing that you can turn the helm over once in a while to other people.

Jayon Wang 29:54

I think a lot of that backstory comes from how our founding team and all founding to teams come together and originally meet. So I'll give you guys just a little bit of insight into our team. One of my co founders when we formed our company was a PhD, MD PhD student at the HST program in Boston. And our other co founder, our third co founder was one of his PhD advisors who was also an HST MD, PhD, LP at from 20 years ago serving as a researcher and a clinician within the Brigham and MGH hospital systems. And we had the benefit of myself. And Brian, who was the PhD student at the time had known each other for almost eight years, nine years, we had done our original engineering degrees together. And had both been running different startups at the time when we first met, which we had both operated for four to five years prior to him starting his MD, PhD, and me doing my MBA at Harvard. So we had a tremendous amount of trust already built up, which I think allowed us to have a team dynamic, though, even though I had just met Dr. Keller, for the first time when we decided to talk about spinning this out. At that point, Brian and Steve had also known each other for three or four years in the context of him doing his PhD. So we had a certain fabric, in terms of our ability to understand each other work together, were having that division of laborers in a founding team, and being able to do it efficiently was was possible, I think, you know, in the role of, of our work at General inception, we see a lot of founding teams, now they're all at the early stage, they're pulling together intellectual property, they're figuring out how to raise that first check of money. And it's, it's not every company that gets to be founded out of a group of people that really already know each other that well, but I think that that trust factor is you can't say enough for it with your co founders, you have to be able to, to know that the most important things that have to get done will get done. And that all the other distractions of which there's always going to be 1000 things pulling it every single person in that early five person or 10 person teams time, will get appropriately ignored when they need to be ignored. Hopefully that answers your question.

David Uffer 32:03

That's great. Last few minutes, good friend of mine always talks on podium about is a VC team TAM and technology, the three T's and where they like to look for investing, we're understand the technologies and the teams that you're building. This is about you, as the core part of the team. Key factors that make you a great bet, and investment, let's just go right down the road, there's got to be some differentiating properties of you and your leadership and management style. Don't be bashful, I may brag about yourself a little bit, but just say why you're good bed.

David Narrow 32:43

So I'll first a couple of us talked before the panel with how you, David, we couldn't find you. And I think some of these things are going to be consistent across the board. So you know, one might look at okay, you haven't had three or four exits. So that's, you know, that's a reason not to invest. But then how do you reposition that to say, Well, what advantages do we have that someone who's done this three or four times doesn't have? I think the first is we have more to gain and more to lose than someone who has exited three or four companies. Maybe we have more energy and stamina, maybe we, you know, have new insights that aren't biased from existing experiences. So I think those are some of the across the board factors that really matter. I mean, I think communication skills are one of the things you know, I started as an engineer, and I hated communication skills going up through school, I was like, How do I avoid that at all costs. And I realized, like that is the most essential skill as a CEO internally, externally writing grants right at the FDA, writing clinical protocols that is absolutely essential, and nailing that down and making it clear and knowing your audience. So the empathy of realizing, selling, raising money to selling stock, you're a salesperson, you need to treat it that way. And as soon as you really appreciate who's the person on the other side of the room, let them talk first figure out what they want. What do they need? How does that fit into my goals? Where does it overlap? And how do you figure this all out how the pieces come together, is where I feel like we've done a good job. And then I think, to the point of the delegating, delegating, that at some point, you start you have to do it all, it's not an option. But at some point, if you're doing it all, you are ruining your company, and optimizing that and hiring at the right time in the right speed and making sure that you're supplementing gaps and your experiences with those folks. And showing that and cultivating that skill set and bringing people into board meetings and into pitches was something that was really helpful for us. So I guess, we have basically we have some unique characteristics by the fact that we're younger that I think are helpful. And then the empathy is the separate piece, I think that we focused on that really helped us and then the final piece is the relationship building. So many times and a non dilutive grant funding. You were able to prove while we were trying to raise money and we're failing that we were executing on other people's money, and people realize not only can you get the non dilutive funding, but you can execute and all these people that said no 1 2 3 times, all of a sudden they started coming in and coming in a big way.

David Uffer 35:00

Rui, little bit to add on that different.

Rui Jing Jiang 35:03

I was going to say you just hit all the points. Alright? Well, the only thing I'd add is that, you know, we're all founder CEOs, which means that we're thinking about the problem and the company, every waking moment of the day. And sometimes we might even dream about it. So the fact that, you know, we are using our brainpower and were able to recruit a team to use their brainpower to solve this problem. I think that's, that's huge. Another thing is that we have a lot of grit and resilience. You've heard today, how many times you know we've each had to face rejection, we've had to find an alternative way to get to where we want to go. I think that says a lot about our ability to overcome challenges in our way.

David Uffer 35:46

Well, look, whether you're an investor, a service provider, or strategic, these four, will be here all week. Seek them out, look for ways to help them along their journey. And if you're going to be around after dinner, meet us in the bar first couple of rounds around Kevin. Thank you very much, everyone.

Ms. Jiang will share the details of Avisi Technologies at the Emerging Medtech Summit and be available to discuss investment and strategic partnering interests.

Rui Jing brings extensive experience in healthcare and regulation. Rui Jing gained corporate development, strategic marketing, and product management experience from working at Allergan and Sanofi, before working at JP Morgan as an equities analyst.

Rui Jing graduated cum laude from Wharton at the University of Pennsylvania with a B.S. in Economics, concentrating in Strategic Management and Finance.

Ms. Jiang will share the details of Avisi Technologies at the Emerging Medtech Summit and be available to discuss investment and strategic partnering interests.

Rui Jing brings extensive experience in healthcare and regulation. Rui Jing gained corporate development, strategic marketing, and product management experience from working at Allergan and Sanofi, before working at JP Morgan as an equities analyst.

Rui Jing graduated cum laude from Wharton at the University of Pennsylvania with a B.S. in Economics, concentrating in Strategic Management and Finance.

Experienced founder CEO with a demonstrated history of working in the medical device industry. Skilled in Management, Start-ups, Financing and Leadership. Strong business development professional with a Master of Business Administration (M.B.A.) from Harvard Business School and B.S./M.S. in Mechanical Engineering from Carnegie Mellon University. 2021 Forbes Next 1000.

Experienced founder CEO with a demonstrated history of working in the medical device industry. Skilled in Management, Start-ups, Financing and Leadership. Strong business development professional with a Master of Business Administration (M.B.A.) from Harvard Business School and B.S./M.S. in Mechanical Engineering from Carnegie Mellon University. 2021 Forbes Next 1000.

A well-rounded executive committed to promoting human health and well-being. Experienced in guiding startups from idea to market, international business development, operations management, investor & public relations, product development and innovation acceleration, from early to commercial stages, in the Healthcare industry, both in the Medical Device and Pharmaceutical sectors.

Successful track record in leadership and top managerial cross-functional roles that require collaborating with multiple teams and stakeholders in the organization.

A well-rounded executive committed to promoting human health and well-being. Experienced in guiding startups from idea to market, international business development, operations management, investor & public relations, product development and innovation acceleration, from early to commercial stages, in the Healthcare industry, both in the Medical Device and Pharmaceutical sectors.

Successful track record in leadership and top managerial cross-functional roles that require collaborating with multiple teams and stakeholders in the organization.

Transcription

Henry Peck 0:08

Our next panel here is med tech the next generation founders and CEOs. This panel is moderated by Dave Uffer, who's the vice president of medtech at General Inception. General Inception is a precede med tech accelerator and venture studio. And we're super excited to have Dave do this panel as well as the rest of the panelists. Dave spent 30 years leading m&a and other corporate development functions at the largest global med tech strategics. And through that experience, he's here to share that with us in the prospect of bringing emerging first time younger new CEOs to the front of our community. So thank you so much, Dave, for doing this panel and overdue.

David Uffer 0:46

Thank you, Henry. And I want to thank LSI and Scott Pantel for just a tremendous conference here really appreciate the opportunity to host each of the panelists. I think, each and every one I've known either since inception, or very early in their journey. And as Henry was mentioning, while I was in business development and corporate development for 25 years, prior to being in venture had the good fortune to screen, about 15,000 companies led by many different prototypes and prototypes of technologies and many different types of CEOs. We want to highlight here is a little bit different ecosystem that I'm seeing in the CEOs that are leading some of the more exciting companies. Most are either first time founders or young in their personal careers, but not for any lack of drive. What I find is just a very exciting crew. I want to start this with giving an introduction to each of them. So I don't want to introduce you please. Name rank and serial number, and then we'll get into some of the content.

Kevin Rocco 1:53

A good afternoon, everybody. My name is Kevin Rocco. I'm the former CEO founder of a company called Biorez. We were acquired by Conmed Corporation in August, and I'm here on behalf of them. Thanks for having me.

Rui Jing Jiang 2:08

Hi, everyone. My name is Rui Zhang Jiang. I'm a founder and CEO at Avisi Technologies. I'm a first time founder and our company is making a nanotechnology enabled implant to treat glaucoma. It's a huge honor to be here. Thank you.

Yuval Mandelbaum 2:22

Good afternoon, everyone. My name is Vaughn Mandelbaum. I'm the CEO of dis cure. And in this cure, we developed quite a unique, smart implantable device to treat and reverse degenerative degenerative disc disease, which is truly one of the larger unmet needs out there today. And we're excited about this. We're going going some interesting places.

Jayon Wang 2:43

Hey, everyone, my name is J. Yan Wang, I'm the CEO at X-Cor Therapeutics. X-Cor is an extra pauriol co2 removal system for treating hypercapnic respiratory failure. I'm a second time founder and I have the unique pleasure of working with Dave at General Inception trying to reimagine how companies get off the ground or co founded and funded through early stage.

David Narrow 3:05

Hey, everyone, it's an honor to be in the presence of such exceptional co founders and CEOs. My name is David narrow co founder and CEO of Sonavex, we're hopping spin out in the dialysis space.

David Uffer 3:16

Great. Well, thanks for the introduction, everybody. I want to start this panel with a little bit of a story from Kevin got to know Kevin many years ago when he had taken a technology that had a little bit of a failure reformulated restarted the company and in his 20s, I might add in had an exit this past summer and north of $200 million. And this was in less than seven years. Very exciting in medtech. I wanted to walk through some of the challenges that you faced in the successes and how you actually restarted to this company and let it through to an exit so early.

Kevin Rocco 3:58

Open ended question just like that, tell the story. Okay. So hey, everybody. So I was the founder CEO of a company called Biorez where we were really committed to improving tendon and ligament healing. You can think of ACL reconstruction, rotator cuff repair. If you've had your ACL torn repaired, it's, it's really a slow, painful process to get back to full activity. rotator cuff tears can fail 30% of the time, retear 30% of the time, so lots of room for improvement on the clinical side. As Dave mentioned, I was actually the second full time employee of a predecessor company called Soft Tissue Regeneration raised $13 million. I had a suboptimal technology and it actually failed. So I was 29. So I guess I was in my 20s. But I did work with the existing investor group. At the time to restart I was convinced that there was a massive unmet clinical need and I think that's what's exciting about being here at a conference like this. It's bringing together really entrepreneurs and operators and investors to try to go after these on MIT needs, there's no doubt that there's a lot of room for improvement across medicine and sports medicine was just one of those places. So kind of fast forward. As Dave mentioned, we set out to make a, an improved mousetrap a version 2.0 of the predecessor of technology. And then along the way, we learned so much more. I think that's maybe one of the lessons we really had a first mover advantage on implants that could add strength to repair but also helped improve the healing process. And based on that knowledge, and based on that investment, we actually ended up pivoting to a different technology company owned IP. So we talk about challenges. I mean, one of the challenges for me, of course, was I was 29 years old, first time CEO, solo founder, no university spin out, no prior exits, no, sort of No, nothing really. And investors don't always like that story. So year in and year out, I would come to conferences like this, meet awesome CEOs meet great investors. But it was a challenge. We ended up raising $12 million, kind of by hook and by crook, just getting it done. We never ended up with really big name brand VCs, we never had 20 $30 million. Some of the folks on this panel are far better at that than I am. So really what we did was we kept the north star as the unmet clinical need. We raised as much money as we needed to get it done. And in the end, really, in the end. The irony is that, while not I couldn't convince all investors of our value proposition. It was very clear to surgeons, it was very clear to patients. And ultimately it was clear to strategics. And I don't know if Dr. Schneider is in the room here, but actually bumped into Steve Schneider out in the hallway. He's a legendary orthopedic surgeon, he ran the Southern California orthopaedic Institute for many years. And he came up to me and said that Conmed buying Biorez was the greatest thing Conrad's done in many years. And so that just made my absolute day, I had to share that because, you know, rewind the tape four years ago, three years ago, two years ago, I couldn't convince investors of that. So in the end, I guess maybe that's one of the takeaways here is like, you got to stay alive, you got to keep going, raise the money, however it takes. And if you solve that problem, you know, for the patient or for the surgeon or for the payer, or for the hospital, or hopefully all of them, there's there's a huge amount of value to be created. And ultimately, that's that's what happened with Conmed, they saw it convents, about a billion dollar revenue company, so they're not able to compete with j&j, or Stryker, or Arthrex, some of the larger incumbents, and they, they knew that they they had to make a move early. And to their credit they did, they, they got us kind of before them, they made a move early. And so far, it's gone great for them. And I'm happy to report you know, today, the the Biobrace was our implant, it's been used over 1000 times in the last 18 months, we have almost 200 surgeons using the implant regularly. And all signs are good clinically. So it's, I think, a smart acquisition by Conmed.

David Uffer 7:56

So this isn't a comment about previous management. But with the restart a recap, what were the critical, critical success factors that you brought in, in a new management team and new to leadership in the style, which led to the success of this program.

Kevin Rocco 8:13

So it's interesting, I live, I live both worlds. And then obviously, I want to open up to the panel here. But I live in both worlds where I worked for a CEO that did have a co founder that was a prestigious surgeon at a prominent university, kind of the tried and true recipe of startup. And I think one of the differences is I'm an engineer by training. So peer reviewed publications in this type of technology. So backing, you know, if I could lobby, maybe the group and I know some of the folks up here are technical as well, you know, backing younger, technical entrepreneurs, I think is key because we would have probably never made that pivot. If if I were just a business person. And note, no disrespect to kind of just business people. But when you're kind of creating new technology, you need to have core competency in that technology. I think that's that was it for me.

David Uffer 9:02

I think what we'll hear is many diverse backgrounds and different success factors really depends on the company and what the objective is. David, let's go to you next. Very unfortunate, large market and ESRD, we will wish we could do to help alleviate some of the suffering in this condition, large growing population, it's pretty crowded area. You've been in an area that's been in your technology with many failures as well as many successes and exits. You're creating a novel new approach to gaining access for these patients. Talk about your experience and where you've had difficulty getting in front of either investors strategics and building out the organization in this particular space.

David Narrow 9:51

Sure. So yeah, the dialysis market is obviously large growing, there's a number of ways to attack it. No single company is going to solve all the problems. I think that has been net positive for us. When we started our company, there were four indications that we were looking at. And where we felt that there was a clear strategy. It was a smaller market, but where we found that there was more interest among all stakeholders in this more complex dialysis space. And I think one of the things that's been helpful for us and this, if you were to ask the question that we were talking about on the panel about, you know, what, what do you do to as a younger CEO, to out compete and to get that capital, it's, you've got to show that maybe you haven't done this three or four times. But you understand the market, you understand the policy, you understand the other players where they stand, how you stand, and you can skate to where the pucks going to be. So I give a lot of credit to my former employer, as a consultant, we had to do this stuff for other people. And I was sort of trained to digest these markets understand what's going on and put together a strategy and in our data room, have PDFs of written up materials, digesting primary and secondary research so that you can convince someone that maybe he knows or maybe doesn't know about this base, that you've got a good grip, and you really understand what you're doing. So I think that's, you know, the concluding statement that I was thinking, the first thing that I saw when we were talking about this panel is, it might be easier to get further down into a fundraising funnel, if you've done this three or four times and you start with an advantage. So you start higher up in that sales funnel, and you just got to get through it. And how do you do that you out, compete and use what you can to your advantage, whether it's surrounding yourself with other people who've been there, done that, by really spending the extra time and effort work ethic to show people you understand this, you're not going to win every time, but you can convert some of those nose into yeses, by being a little more aggressive on the front end.

David Uffer 11:35

Interesting perspective, gentlemen, before Kevin gets mad me for not going back to biomedical engineering founders and background, you actually have both sides of it in that background, in engineering, from Carnegie in the business side from Harvard, as well as your on your second company, under 40, companies founded and started a little bit about your journey and the experience of getting the second one off the ground when you already had done that once before.

Jayon Wang 12:09

Yeah, I think that it's probably a shared experience for all of us on the panel that as a early career leader or a founder, you know, you have it's given that you have to try and overwork and use every ounce of grit, you have to try and avoid all of the major mistakes and bullets that can probably end an effort. But I would say that, again, it's probably a shared experience for all of us that when companies and products do end up finding that product market fit when they do end up successful when they do get funded and see commercial success. You know, while we can be the glue that holds a lot of that team together, I'm sure all of us have a village of of senior scientists, clinicians that we've worked with, as well as junior engineers, quality folks, you know, across the board, and as well as out of house service providers that are willing to work with us to provide the the kind of village labor effort that makes these things successful. By no means is it ever like a one person show. And I think what I really learned the most out of my first company, second company, being exposed to so many other founders, teams operating in engineering worlds or business worlds, maybe even unrelated to medical devices is that ability to work together stay together over the five year 10 year period it takes to make any of these things real is kind of the differentiating factor, I think that really leads a lot of companies to success versus tripping up on those earlier milestones.

David Uffer 13:45

You've all it's moved to you next time, you come from a unique experience being part of an incubator in Israel and actually took one of the companies to say I'm going to take the helm in the reins and lead this little bit about the challenges that you've faced A being first time CEO, and B, you're doing this from afar outside of where the greater amount of capital is, is typically circulating in the US. And certainly there's a really nice access between Israel in Europe, we've seen a lot of money in the past that was coming from China, but you've got to be on the global circuit. There's not a lack of innovation in Israel, but there's certainly a lack of capital of support the medtech industry.

Yuval Mandelbaum 14:28

Now that's 100% Correct. Like I think as an Israeli CEO kind of living in a island country, where you can innovate in Israel, but you can't a fund and you can commercialize. So you have to kind of look outward. And beyond that circuit, I was just remarking today that kind of feel like on the tennis racket with tennis circuit with my Israeli friends who are in the conference, because you keep seeing the same people in same faces if it's in Dublin, or if it's in California or Boston, and the same faces kind of keep popping up. And with respect to coming out of an incubator and kind of taking the helm, on a new innovation and a new spin out company that has been developed. I think it's true for me, it's true for pretty much every new CEO, or first time CEO, you have a chip on your shoulder, and you have to prove, kind of prove your worth. And you have to do that, as my friends here said, you have to do that through execution. There's really no other way. Because you can't you can't show any past accolades as a reason why you should fund this, you have to show validation, you have to show milestones, and you have to really execute on what you promise and deliver. And I think the other side of that beyond the execution side, is really that first time CEOs, I think, come with a certain humility, that you don't always like I would expect you wouldn't always have with successful or if previously successful CEOs. And the advantage that comes with that is really the ability to surround yourself, as I think everyone here has said, there's really no other way to execute, and to surround yourself with mentors, with employees that are perhaps smarter than you or experienced than you. And that can really help you in this journey. And it really takes a village. I think that's it's a cliche, but it's, it's true. And like, in my personal experience, we've been I've been surrounding myself with every smart, experienced person that I can, and kind of try to put my ego aside here. And I think that's easier when you don't have all that track record behind you. And you can really leverage a lot of that experience and shared experience from board members, mentors, employees, for example, I'm probably 10 years younger than the second youngest employee in my company. And we have people with 30 years of experience and clinical development, 20 years of experience in r&d development. And I think that's paramount in order to succeed as a first time CEO.

David Uffer 16:50

I want to expand on that, but in just a moment, because I have to get to Rui This is one of the warmest stories I have in that if anybody hasn't met Ben Glenn here, you shouldn't running meta innovation, doing amazing press and called me one day said, Dave, you have to come up to MIT, we've got an amazing crew of companies that's going to present and really need some mentorship, I went there and met Rui. I don't want to be rude, but I have to say greener than the Hulk, in experience, came out of UPenn found a technology there and built an application and market greener than the Hulk but not smaller or more aggressive. I'm talking somebody that was demonstrating amazing leadership and taking a technology that she found at the university. And I'll say in the past five, six years is won more awards than I could count in leading this company. Talk about this experience, going from undergraduate in UPenn, and finding a technology and saying I'm going to find a clinical application and market for this.

Rui Jing Jiang 17:55

Thank you for the kind words, Dave, I mean, we wouldn't be here if it weren't for mentors like yourself, who are so generous with your time and your experience to help us see around corners. So our story out of UP as a little bit unique, we really focused on the clinical need. In the very beginning, there was a very novel technology invented at the University of Pennsylvania that was marketed as a thin film as thin as a soap bubble, but ultra light and robust, and people weren't really thinking about using it in healthcare applications. For our team, you know, we're really motivated to think about issues and vision because the eye is a very small organ, and yet it's responsible for how we interact with our world. When we started speaking with ophthalmologist, they were the ones who pointed to glaucoma as one of the biggest emerging needs that a small, thin, robust technology could really help impact and improve. When we went and met you at MIT, I think we were a group of 20 year olds, obviously had never run a company before. And I think it's that intellectual humility that you've always talking about here. That enabled us to ask for help, not just from you, but also from ophthalmologists. We spent countless hours shadowing at conferences like this and that American Academy of Ophthalmology, shadowing and the OR are asking very basic questions like, Why do you use this implant in this way? Why do you hold this tool to do this maneuver? And what does that mean for the patient? We shadowed and follow up visits where we heard patients talk about their frustrations with medications that made their head spin or their eyes hurt, or just impacted their daily quality of life. And I think taking all of those lessons, being open to the advice that was coming towards us, and being unafraid to fail has really helped us get to where we are today. So the company has raised over seven and a half million dollars. We have completed enrollment and our first in human clinical trial. We've treated over 22 patients around the world, and it's looking really good. So I think If not for, again, mentors like you and the ophthalmologists on our team, we definitely wouldn't be here.

David Uffer 20:06

So I guess coming back to Kevin's original point, just don't think of the business what I'm hearing a common theme is you're always starting with the patient in mind and what's going to benefit the patient, and the clinician who's going to deliver this technology in use the technology, whether it's a better patient outcome, it's faster, it's easier to use, it helps them whatever that be, but the two constituents of the patient and the clinician, and then you'll work on the entire business plan, which of course, you don't have a company without a business plan. But that's your starting point. Talk about the not afraid to fail, David, again, we talked about some roadkill in your space, but you're charging hard in a very important area, what have been some of the errors that you've learned from either other failures or that you're keeping your sightline to say, here's what we need to do to not end up where they did and what we're doing differently?

David Narrow 20:54

Yeah, I think the important part is you don't just stop at the patient and the clinician, right? Those days are over, you got to figure it out. Everybody that has a direct and indirect impact on stake a stakeholder right. And some of these markets are more complicated than others. Obviously, dialysis is probably on one end of the spectrum. And maybe some of these others are simpler. But, you know, for us, we're looking at first and foremost, the patient. You're looking at the physician here, there are multiple physicians, you've got an astrologist, you've got a surgeon, you've got the dialysis organization, you've got the hospital, you've got the payer, and making sure that everything that you're thinking through, you're going around and ensuring that the strategy is satisfactory for each of those stakeholders. And I think in the dialysis space, in particular, that's where most of these companies that failed, there might be something that's 10, or 20, or 30%, better for the patient. But if it's not compatible with all the other stakeholders that enable that technology to get to the patient doesn't matter. So that's a word of wisdom or something that we've spent a lot of time focused on. Because if you don't satisfy those other checkboxes, that technology never makes it to the patient.

David Uffer 21:58

You've all you'd mentioned, look, you're not you have to be a jack of all trades, maybe you're not the expert in every discipline, knowing when the buck stops with you at the end of the day as the CEO, but you have to be able to read through somebody telling you whether they're your head of clean ups or regulatory, here's my direction, and you have to make those decisions. Is it really surround yourself with people that you have to either trust or test and make those decisions or you trust them? Implicitly, you've hired them you put them in place? How do you decide when they probably have a lot stronger background in those particular disciplines than you.

Yuval Mandelbaum 22:36

You know, I'm referring said about being without ego at this early stage, I can't say that's entirely true. Sometimes you do bring your ego to the table and like, so you do want to trust you bring on people who you trust to, I couldn't take their place like like my Chief Clinical Officer, like she's run over 15 First in human studies, and like five pivotal roles. So I'm not going to tell her how to do her job. That being said, I do want to hear everything she has to say. But at the end of the day, you want to make sure that everything checks out, and that you're certain that's the right way to go. So you do also want to validate that not just with your own common sense, but as well as the mentors that you surround yourself with on your board. And, you know, I think we're not a large group. And we do try to do things kind of holistically, and not just hierarchically and we work as a team, we work as a matrix, we make important decisions. As a group, I do have the final word on that, me or my board or with my board. But we do try to make these large decisions as a group bringing in everyone's experience. Like it's not one person's decision if it's, if we're doing, I don't know, a certain endpoint or another for clinical study, or if we're selecting one manufacturer or different one. Like we're bringing on really top notch people to help us with that. So Beyonds, we're a small team of four people full time two people part time, but we augment that team with really top notch advisors in key areas. So if that's groups that help us with approaching FDA or selecting the right manufacturer, and development partner, so that those are not the decisions that can always make by yourself, or just with your team, you want to kind of branch that out and got a larger spectrum of opinions and perspectives from people have really had a lot of experience. And that's what we generally try to do.

David Uffer 24:35

Great got to change up just a bit of direction. I made an acquisition that logic of a company that was led by somebody with 20 plus years experience leading a multi billion dollar company in one of their business units. A week after I acquired it. He called us a diva, you know how hard it was for me to raise capital. Even with my background and experience it was getting inched shut out no so many times. And now everybody's calling me all the VCs are calling me say, what's your next company we want to invest, we want to invest. It's difficult to raise capital, regardless of if you've been there and done that before, if this is your first time, but even is, you know, somebody that hasn't been part of a major organization, 25 year track record, let's not be too rosy, tell me about the challenges of really getting funded and working through these issues with the VC community. That's for you.

Kevin Rocco 25:33

I mean, I can't reiterate enough, the challenge is probably the struggle for me, I don't know about the rest of the team here. I was trying to, we were never well capitalized. So I never was able to go out and hire all the experts to be kind of out of the gate together. So we were trying to build the car and drive the car at the same time and kind of being the lead on technology and development, while also being the CEO was very challenging, because I know firsthand that my slides and my story aren't that good. Like, I'm smart enough to know that at least right? So when I go up on stage, it's like, yeah, I know, this cartoons really cheesy. I know, this isn't as good as it could have been. But I also didn't have $100,000 to spend to make it all really good. So I'm sitting there and economy like a T Rex trying to work on my MacBook to get my slides to look good coming out here. And, and so. So there's an element of that, which is like, if I could have focused 100% of my time, on just doing that, I would have been probably a lot better at it. So I think for me, that was one of the challenges. And yeah, I mean, it never ended. But I was very fortunate to find, you know, just enough investors that believed in it saw it believed in me, or maybe even better, they put a little bit of money in. And then they were along for the ride for a little bit. And they got to really see firsthand what we were doing. And then the team that we started to build and the mission we were pursuing. And, you know, I love medtech entrepreneurship. I think there needs to be more of it. And I think that it is funny to come back a year later, when just a year ago, I was here trying to raise money. So a lot can change in here.

David Uffer 27:19

Right? Look, you've taken on a very difficult era, I was 20 plus years ago, of all places at Boston sigh when I was bizdev, we were doing a white space slash Skunk Works project in ophthalmology. And when we met, I was so excited, I could actually say trabecular mesh, and know a little bit of something in ophthalmology and I saw so many challenges of doing what you're doing. Not only the raising capital, but building in a very difficult market. What have been the greatest challenges that you've been facing and what's led you to push through these.

Rui Jing Jiang 27:55

So when we say a difficult market, it's very crowded, because Glaucoma is a very big problem that affects over 140 million people. There are a lot of competitors. But I think the reason why there's still opportunity and why investors are still excited is because of new material technologies. And that's what we're working on. I think when you can have a very differentiated product and speak directly to how physicians will adopt it, how it will impact their patient outcomes and how it can, you know, save money for the healthcare system. That is a very compelling value proposition. I think some of the challenges, you know, early on, as Kevin alluded to, it is hard to raise money for for everyone. And for us, we really tried to rely on non dilute of capital in the beginning. We wrote, you know, many, many grants. I think when we left the university we had $300,000 in non dilutive funding. From there, we got 250k from the National Science Foundation phase one SBIR, and then from there, we got a phase two $1 million grant from the SBIR program, and kind of staying away from dilute of capital as long as we could to get to a point where we had some proof of concept for our value proposition that helped us, you know, overcome some of those early funding challenges that I again, I think every CEO will face.

David Uffer 29:14

Jayon, moving over to you, you. You're able to lead a team without having to take on every role and really delegating you have a tremendous clinician, on board, you've got a great new technology developer, you've got a great co founder. And it doesn't seem like you have to put your finger on everything that you have a great trust with your team tells us about when to jump in and when to back off and let people lead independently and how you motivate them. Keep that kind of CEO role. They're overseeing everything but knowing that you can turn the helm over once in a while to other people.

Jayon Wang 29:54

I think a lot of that backstory comes from how our founding team and all founding to teams come together and originally meet. So I'll give you guys just a little bit of insight into our team. One of my co founders when we formed our company was a PhD, MD PhD student at the HST program in Boston. And our other co founder, our third co founder was one of his PhD advisors who was also an HST MD, PhD, LP at from 20 years ago serving as a researcher and a clinician within the Brigham and MGH hospital systems. And we had the benefit of myself. And Brian, who was the PhD student at the time had known each other for almost eight years, nine years, we had done our original engineering degrees together. And had both been running different startups at the time when we first met, which we had both operated for four to five years prior to him starting his MD, PhD, and me doing my MBA at Harvard. So we had a tremendous amount of trust already built up, which I think allowed us to have a team dynamic, though, even though I had just met Dr. Keller, for the first time when we decided to talk about spinning this out. At that point, Brian and Steve had also known each other for three or four years in the context of him doing his PhD. So we had a certain fabric, in terms of our ability to understand each other work together, were having that division of laborers in a founding team, and being able to do it efficiently was was possible, I think, you know, in the role of, of our work at General inception, we see a lot of founding teams, now they're all at the early stage, they're pulling together intellectual property, they're figuring out how to raise that first check of money. And it's, it's not every company that gets to be founded out of a group of people that really already know each other that well, but I think that that trust factor is you can't say enough for it with your co founders, you have to be able to, to know that the most important things that have to get done will get done. And that all the other distractions of which there's always going to be 1000 things pulling it every single person in that early five person or 10 person teams time, will get appropriately ignored when they need to be ignored. Hopefully that answers your question.

David Uffer 32:03

That's great. Last few minutes, good friend of mine always talks on podium about is a VC team TAM and technology, the three T's and where they like to look for investing, we're understand the technologies and the teams that you're building. This is about you, as the core part of the team. Key factors that make you a great bet, and investment, let's just go right down the road, there's got to be some differentiating properties of you and your leadership and management style. Don't be bashful, I may brag about yourself a little bit, but just say why you're good bed.

David Narrow 32:43

So I'll first a couple of us talked before the panel with how you, David, we couldn't find you. And I think some of these things are going to be consistent across the board. So you know, one might look at okay, you haven't had three or four exits. So that's, you know, that's a reason not to invest. But then how do you reposition that to say, Well, what advantages do we have that someone who's done this three or four times doesn't have? I think the first is we have more to gain and more to lose than someone who has exited three or four companies. Maybe we have more energy and stamina, maybe we, you know, have new insights that aren't biased from existing experiences. So I think those are some of the across the board factors that really matter. I mean, I think communication skills are one of the things you know, I started as an engineer, and I hated communication skills going up through school, I was like, How do I avoid that at all costs. And I realized, like that is the most essential skill as a CEO internally, externally writing grants right at the FDA, writing clinical protocols that is absolutely essential, and nailing that down and making it clear and knowing your audience. So the empathy of realizing, selling, raising money to selling stock, you're a salesperson, you need to treat it that way. And as soon as you really appreciate who's the person on the other side of the room, let them talk first figure out what they want. What do they need? How does that fit into my goals? Where does it overlap? And how do you figure this all out how the pieces come together, is where I feel like we've done a good job. And then I think, to the point of the delegating, delegating, that at some point, you start you have to do it all, it's not an option. But at some point, if you're doing it all, you are ruining your company, and optimizing that and hiring at the right time in the right speed and making sure that you're supplementing gaps and your experiences with those folks. And showing that and cultivating that skill set and bringing people into board meetings and into pitches was something that was really helpful for us. So I guess, we have basically we have some unique characteristics by the fact that we're younger that I think are helpful. And then the empathy is the separate piece, I think that we focused on that really helped us and then the final piece is the relationship building. So many times and a non dilutive grant funding. You were able to prove while we were trying to raise money and we're failing that we were executing on other people's money, and people realize not only can you get the non dilutive funding, but you can execute and all these people that said no 1 2 3 times, all of a sudden they started coming in and coming in a big way.

David Uffer 35:00

Rui, little bit to add on that different.

Rui Jing Jiang 35:03

I was going to say you just hit all the points. Alright? Well, the only thing I'd add is that, you know, we're all founder CEOs, which means that we're thinking about the problem and the company, every waking moment of the day. And sometimes we might even dream about it. So the fact that, you know, we are using our brainpower and were able to recruit a team to use their brainpower to solve this problem. I think that's, that's huge. Another thing is that we have a lot of grit and resilience. You've heard today, how many times you know we've each had to face rejection, we've had to find an alternative way to get to where we want to go. I think that says a lot about our ability to overcome challenges in our way.

David Uffer 35:46

Well, look, whether you're an investor, a service provider, or strategic, these four, will be here all week. Seek them out, look for ways to help them along their journey. And if you're going to be around after dinner, meet us in the bar first couple of rounds around Kevin. Thank you very much, everyone.

Market Intelligence

Schedule an exploratory call

Request Info17011 Beach Blvd, Suite 500 Huntington Beach, CA 92647

714-847-3540© 2024 Life Science Intelligence, Inc., All Rights Reserved. | Privacy Policy